Buy Tether (USDT)

In cryptocurrencies, there are digital coins whose value is tied to a specific physical asset. The first such digital currency, USDT from Tether, appeared in 2015. It is pegged to the value of the US dollar at a ratio of 1:1. Since then, the number of stablecoins has increased markedly.

Tether is a cryptocurrency that uses the bitcoin blockchain. The coin is pegged to fiat money, including the dollar, the euro and the Japanese yen. It is used for various financial transactions. The token is issued by Tether Limited Corporation, which claims that the coin is backed by a real stock of assets in its accounts. In other words, 1 million tokens equal 1 million fiat currencies.

What is Tether (USDT)?

Tether cryptocurrency is a digital asset that differs from other coins by being backed by fiat (real) money. Such a feature excludes speculators. The Tether (USDT) platform converts US dollars.

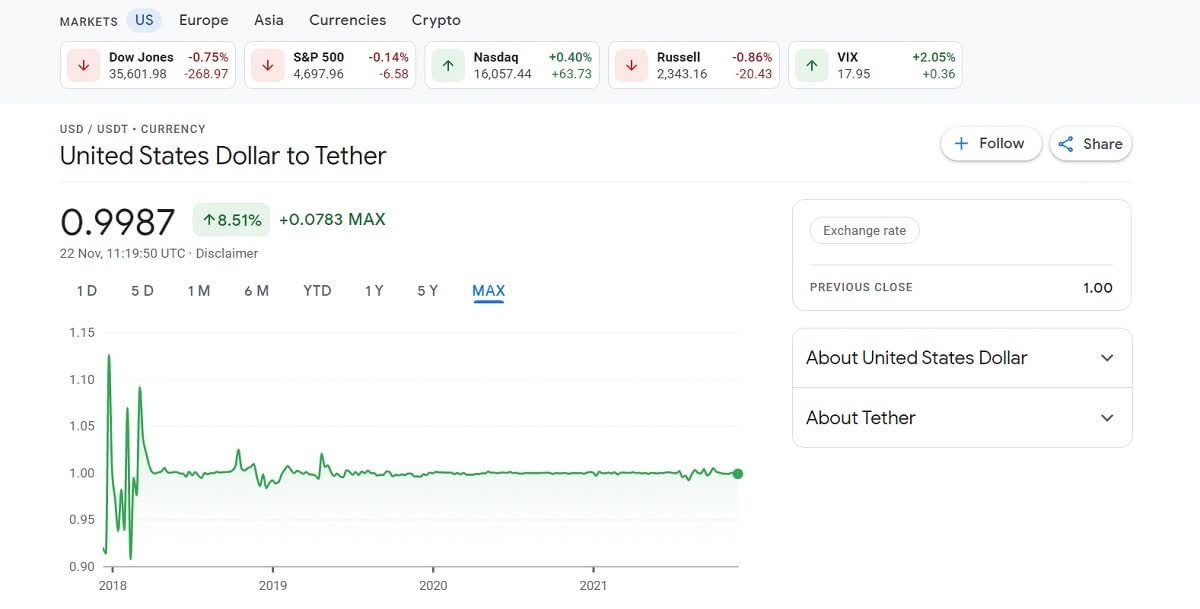

The digital currency is based on an open-source Omni Layer protocol that works with the blockchain. This enables the creation and redemption of Bitcoin-based tokens. Users can transfer, buy coins for other cryptocurrencies or fiat money, and store them in wallets. The creators of Tether Limited assure that 1 Tether coin is equal to $1. In practice, there are small exchange rate fluctuations, but they do not exceed $0.1. The reason could be the fake pegging of the coin to fiat.

Bitcoin was previously seen as a promising digital currency that could provide maximum security, fast and convenient payments. However, at the end of 2017, it became clear that this could not be achieved but was perfectly suited to speculation. The cryptocurrency exchange Bitfinex took advantage of this by creating the token Tether (USDT). Within one month of the new currency's creation, half a billion coins were issued, Bitcoin began to rise sharply in value to $20,000, followed by a sharp decline.

Blockchain and the real world

Additionally, many people want to buy USDT but don't understand the purpose of stablecoins in the crypto world.

People practice a measure in fiat currency in the physical world, but blockchain does not recognise the euro or the dollar; it has its own metrics - block size, number of transactions, and hash rate.

So stablecoins were created to bring blockchain closer to the human world and make it an asset perceived as a unit of value.

Additionally to being attached to fiat currencies, stablecoins can be connected to precious metals, natural resources, securities, real estate, and other physical assets. Because of this, stablecoins have less volatility.

Distinguishing features of Tether

Compared to Bitcoin, Tether is on the collateral of real money, which is held in the accounts of Tether Limited. Thus, the first cryptocurrency is made as an alternative to fiat money and to remove intermediaries during financial transactions.

Tether is made to inject real funds into the blockchain by digitizing them. Today, this mechanism is considered the best security for storage or transfer.

The operation of the coin depends on reliable links to banks, other institutions of a similar type and government support.

The main features of cryptocurrency are as follows:

- the number of coins is limited solely to the invested money in the founder's company accounts;

- the first coin was created on 12.03.15;

- the token has no transaction blocks.

Distribution is possible via money transfers to Tether Limited accounts, and the company itself issues a corresponding number of coins that can be backed by fiat money. Multiple transfers are available to traders, transferring coins to each other or for input to exchanges.

The level of confidentiality can be considered zero, as the funds are transferred to an account where the customer needs to complete the KYC procedure. This step is necessary to provide personal details, passport information, place of residence and other personal information. Thus, the founders know practically everything about the depositors. Tether functions on a BTC blockchain, in which case the transaction process is fast.

If you want to buy Tether, pay attention to all aspects to reduce risks.

What is the investor's benefit?

Of course, those wishing to invest in Tether want to make a profit. But how can they do so if it is not volatile in principle?

In the cryptocurrency market, stablecoins perform as a buffer. Through stablecoins, keepers of meaningful capital can join the crypto market. This is convenient because you can turn a vast sum of money into money inside the blockchain at once and trade or invest with it.

There is also the reverse circumstance, where an investor has a lot of cryptocurrencies and doesn't want to waste their features. Then the investor changes the cryptocurrency into Stablecoins and waits out volatility in the crypto market.

Another benefit of stablecoins is that this kind of asset could finally become an alternative to the regular fiat currencies in countries where the regional currency is unstable.

These assets could become a transitional option for settlements in unstable economies, where conventional fiat money is often rapidly losing value.

Perhaps digital assets based on real tangible assets will only grow in popularity in the future. So even though cryptocurrencies are a risk, it may still make sense to buy USDT.

Principle of operation

The platform's core functionality provides convenient, fast transactions by converting fiat currencies into their stable digital counterpart. How the system works:

- A user creates and verifies an account with Tether Limited. You choose the type of account ("Corporate" or "Personal"), enter your name, surname, country of residence, and then fill out the "Know Your Customer" (KYC) form and get verified.

A $150 verification fee, expressed in tokens, must be paid. This deposit is non-refundable, even if the account is rejected.

- The user opens the "Deposit" tab and deposits the Tether Limited account in fiat currency.

- The system generates and accrues tokens to the investor at a ratio of 1 to 1 ($10 = 10 ₮ USD).

- The user can conduct any operations with the cryptocurrency: make transactions both to the accounts of companies and individuals, exchange it for other coins, keep it in the account.

- To get the fiat back, the holder sends the tokens to the company's account.

- The firm destroys them and forwards the dollars to the user.

- The investor can order payment to a bank card. If this is done directly through the platform, a fee will be paid.

The minimum withdrawal amount in fiat currency: $100k.

Such conditions within the system are caused by the need to maintain the project's solvency.

But although Tether Ltd. is the only issuer that can generate tokens and destroy them, users have the right to make transactions outside of the platform. That is, buy, sell, exchange ₮ USD is allowed on exchanges. Then there is no need to deposit and withdraw large sums of $100,000 or more.

What about transaction velocity?

If you want to buy Tether in the UAE, there are many important things to consider. One of the major pluses is the speed of transactions.

The project is constantly finding new solutions for faster transfers. Initially, tokens were only issued through the Omni protocol, and the transaction speed was 5-7 TPS. Then, the developers decided to use other blockchains with higher throughput in parallel to solve the scalability problem.

Collaboration with Ethereum made it possible to increase the speed up to 15 TPS. But the real breakthrough was the move to the Solana network, which offers solutions for DeFi (decentralised finance and modern Web 3.0 protocols).

The blockchain made it possible to transfer Tether coins (USDT) at a speed of 50,000 tx/s. It takes only 400 milliseconds to process a block. In comparison, Ethereum's process takes 15 seconds. And a block can hold more transactions in a short period than is possible in other blockchains. There is no damage to security or decentralised governance.

The high speed in Solana blockchain is achieved by using a non-standard consensus method - Proof-of-History (PoH).

The use of Avalanche networks with enhanced decentralisation and Kusama + Polkadot, which use a pooled distributed ledger (parachain) system, will further increase speeds.

Proof-of-History (PoH)

If you're considering investing in Tether, you've probably seen the odd words - Proof-of-History - in more than just this article. So what do these cryptic words mean?

Proof-of-History (PoH) is a blockchain synchronisation algorithm with an internal clock showing the same time on all nodes. Nodes on the network run on a schedule, and because of the synchronisation, they can check the time between transactions in the blockchain.

In this way, the application of PoH allows the creation of a historical record that proves that an event occurred at a certain point in time.

For example, such an algorithm is used in the Solana blockchain. While other blockchains require validators to communicate with each other to agree that time has passed, each Solana validator maintains its own clock by encoding the passage of time and using delayed-function-delay (VDF) with sequential hashing. Thus, Proof-of-History is a fundamental step forward in the structure of blockchain networks in terms of speed and throughput.

To give you some clarity6, if you want to buy Tether, let's define what a validator is.

Validators are the backbone of the entire blockchain system. They enable the transfer of information between blocks and secure the network by compiling their own metrics, which are later transmitted to the head offices. Thus, a validator stands between all users, knowledge and the blockchain itself.

The validator is a set of software. A person or team runs it, sets it up and controls it. The software complex itself can exist without the 'creator' being involved.

Where to buy Tether?

Most transactions are made through centralised exchanges, ranked among the top 10 in terms of capitalisation. Therefore, this option is suitable even for a beginner. For example, Stablecoin is traded on most major centralised platforms: Binance, Huobi Global, KuCoin, Kraken.

How to start investing in Tether (USDT) in the UAE?

If you want to invest in Tether in the UAE, a classic investment will not work here. The cryptocurrency price is not expected to rise, but it will be stable. Therefore, it is an option for those who want to keep their savings and protect them from inflation (in the case of fiat) or falling markets. You can also buy USDT, if you are concerned about the price of another volatile cryptocurrency.

To sum up

The cryptocurrency industry is changing. In recent years, a large number of new products have been created. Perhaps the most prominent of these is Stablecoin, a special kind of digital coin that helps speed up the emergence of digital money in everyday human life. Bloomberg predicts that USDT will displace Ethereum from its position as the second most capitalised digital currency as early as this year. The growth of Tether cryptocurrency is attributed to widespread adoption and a peg to the dollar. In addition, the coin is increasingly being used by blockchain developers to service transactions in applications.

So choose what you like and make money. You will get through this!