Buy Uniswap (UNI)

The market for cryptocurrency trading platforms can be divided into two categories, depending on how the workflow is organised: centralised and decentralised. The first group includes popular exchanges such as Binance and Coinbase.

For a long time, the centralised approach to organising trading platforms was the only solution available.

With the rise of the decentralised finance (Defi) market and the idea of abandoning systems where project management is in the hands of its representatives, there are many platforms in the second category. One of them, Uniswap, has become particularly popular. We tell you what's unique about the platform and how to make money with it.

What is Uniswap?

Uniswap is an open-source, decentralised protocol based on the Ethereum blockchain. The project was launched in 2018. It can be used to exchange ERC20 tokens issued on the Ethereum blockchain quickly and securely. This functionality allows Uniswap to be called a decentralised exchange.

Interesting! The developer of Uniswap was Hayden Adams. For the basis of the project, he took the idea of one of the creators of Ethereum - Vitalik Buterin - to organise a decentralised exchange (DEX). The young man shared his vision for developing such a platform with Reddit readers in 2017. Ironically, Hayden Adams subsequently received a $100,000 grant from the Ethereum Foundation to develop the project.

How does Uniswap work?

Unlike centralised exchanges, Uniswap does not have an exchange ledger, with which traditional trading platforms calculate supply and demand for particular assets and find and connect buyers and sellers. Instead, the project uses an automated order processing system based on * intelligent contracts.

*Smart contracts are the key to automating the trading process. They are digital equivalents of contracts that spell out the terms of the "deals". For example, a smart contract will not allow the system to exchange tokens if the user does not have enough money in their account.

There are two types of smart contracts in total on Uniswap:

- Exchange contracts (Exchange). They contain pools of tokens and Ethereum that users can exchange with.

- Factory contracts. The tool is responsible for creating new exchange contracts in the system. Factory can also be used to bind an ERC20 token to a personal exchange contract.

Technically, Uniswap works as follows:

- The exchange bundles identical tokens into so-called "liquidity pools" (Uniswap liquidity pools) - reserves of coins that can be represented in the form of storage cells. Uniswap users can exchange one currency for another at any time. The amount of assets a trader needs is taken from the "safe deposit box" during transactions.

- The system conducts the transaction with the help of smart contracts.

This arrangement allows traders to exchange cryptocurrencies directly from each other, bypassing intermediaries. If you are going to buy Uniswap, you should have a solid grasp of that token.

Centralised and decentralised exchange

Let's compare the standard token exchange process on Uniswap and the centralised exchange to demonstrate how much easier the work on the decentralised platform looks. If you want to buy Uniswap, the savvy investor needs to know the differences.

Uniswap:

- The user transfers tokens for exchange to the address specified by the system.

- The system automatically makes the exchange and sends the desired tokens to the user's address.

Centralised Exchange:

- First, you need to register and verify your identity.

- After that, one has to fund the exchange account in the cryptocurrency to be exchanged.

- Next comes the stage of making an exchange request, by which the exchange will look for options to conduct the transaction.

- The next step is to conduct the exchange.

- After that, the user can withdraw the exchanged tokens from the exchange to a working wallet.

What are liquidity and liquidity providers?

Liquidity is a measure of how quickly an asset can be turned into money without losing value. And the faster it can be done. Therefore, the more liquid an asset is considered to be.

To make it more transparent, let's explain it with an example:

Let's say you have Bitcoin and you want to sell it at the current rate. It is effortless to do: BTC is traded on many different exchanges. Therefore, its price will not be undervalued and exchanging it for cash is a matter of minutes. This shows that BTC is a liquid asset.

Now let's imagine that you have some obscure XXX tokens that you want to sell. They have a price announced by the project team at the coin selling stage, but the tokens themselves are not listed on decentralised exchanges. On the only centralised exchange where they are traded, a buy order is placed 20% below the market price. So you can't sell it quickly and without a loss in price, and XXX is an illiquid asset.

What does all this have to do with Uniswap? Transactions on the exchange are instant. There are no buy and sell orders. So a logical question arises: how does it all work?

The answer is simple: the liquidity providers allow the exchange to transact instantly. These are cryptocurrency owners who lend their money to the exchange so that transactions can occur immediately and without losing value. Liquidity providers contribute amounts equivalent to the value of the tokens to the balance of the trading pair's smart contract. In return, the exchange pays them remuneration in the form of Uniswap liquidity tokens (UNI) in proportion to each contribution.

History of Uniswap

The creators of Uniswap were inspired by Vitalik Buterin's Automated Market Maker (AMM) concept. It is the concept of automated liquidity providers that made the creation and success of decentralised platforms possible.

In 2016, Buterin published on Reddit the idea of the project and several ideas for its technical implementation.

Hayden Adams, a former Siemens mechanical engineer, took on the idea. He began developing Uniswap and later received several grants to implement the platform from the Ethereum Foundation.

The exchange itself was introduced to the world in 2018. And in April 2019, Uniswap received $1000000 for development from investment company Paradigm.

In May 2020, Uniswap V2 was released, making the exchange more reliable and secure for users.

Pros and cons of the exchange

Cryptocurrency community members believe that the project has both advantages and disadvantages. Therefore, we propose to get acquainted with them more closely.

Advantages of Uniswap:

- The automation of the token exchange process has accelerated the speed of transactions.

- The simplicity of working on Uniswap and the open access to operations on the platform allowed the exchange to form large liquidity pools. This approach has also had a positive impact on the speed of the platform.

- Wide choice of tokens.

The disadvantage of Uniswap is:

- Due to the congestion of the Ethereum network amid the popularity of Defi, transaction fees on Uniswap often become prohibitive. As a result, sometimes, users are forced to raise the fees themselves to complete a transaction.

Uniswap token (UNI)

UNI is the Uniswap protocol's token, which gives its holder's management rights. That means that UNI holders can vote for changes to the protocol.

When Uniswap was created, 1 billion UNI tokens were issued, 60% of which were distributed to existing Uniswap community members. The remaining 40% will become available to team members, investors and consultants within four years.

A portion of the tokens is distributed to the community through liquidity mining. In particular, UNI tokens will be distributed to those who provide liquidity to the following Uniswap pools:

- ETH/USDT.

- ETH/USDC.

- ETH/DAI.

- ETH/WBTC.

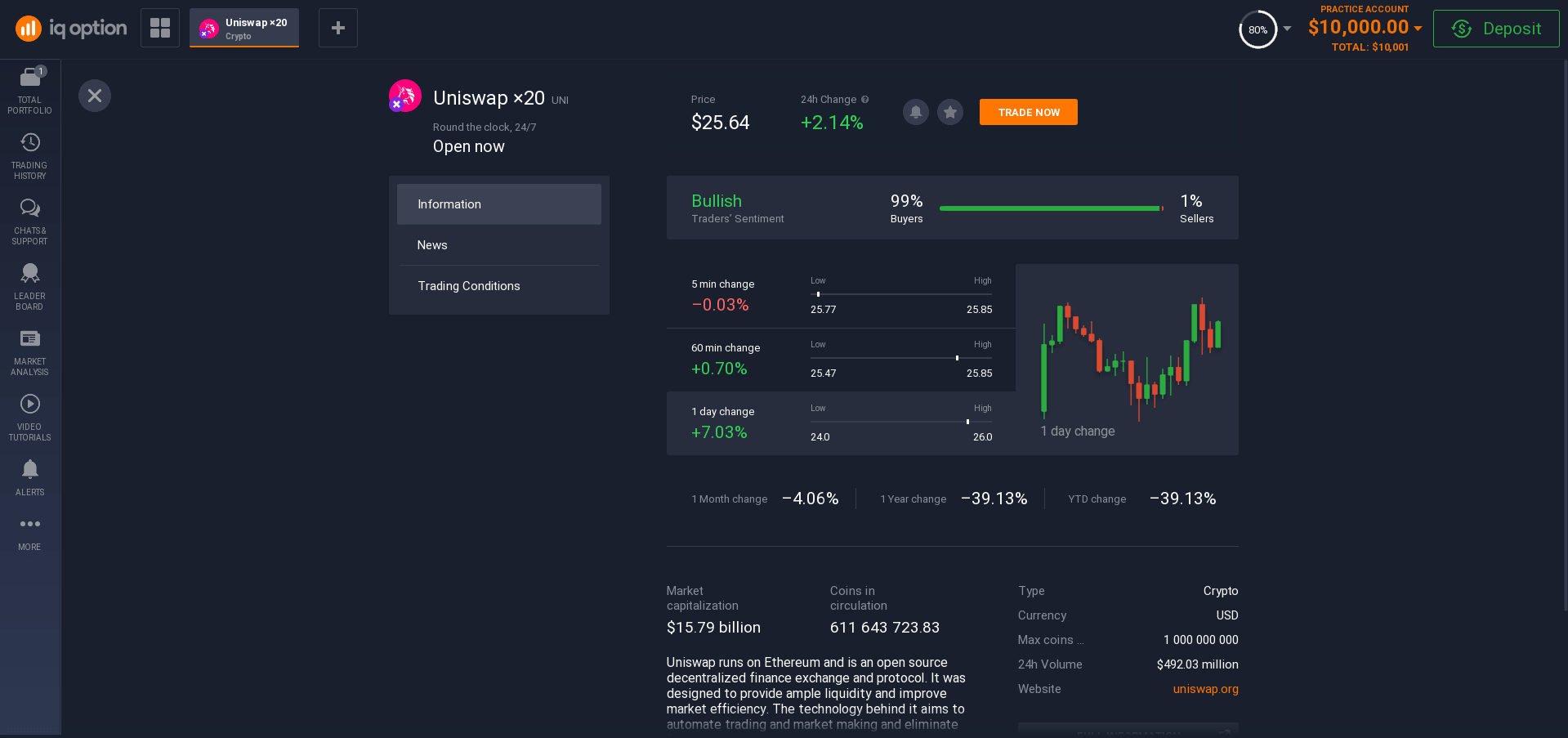

Is it safe to invest in Uniswap online?

As with any technology, the best way to understand Uniswap is to start using it. One of the main advantages of Uniswap is that traders can make transactions directly from their wallets without any validation. The platform is also secure because it is not linked to storage, and the protocol does not store any funds.

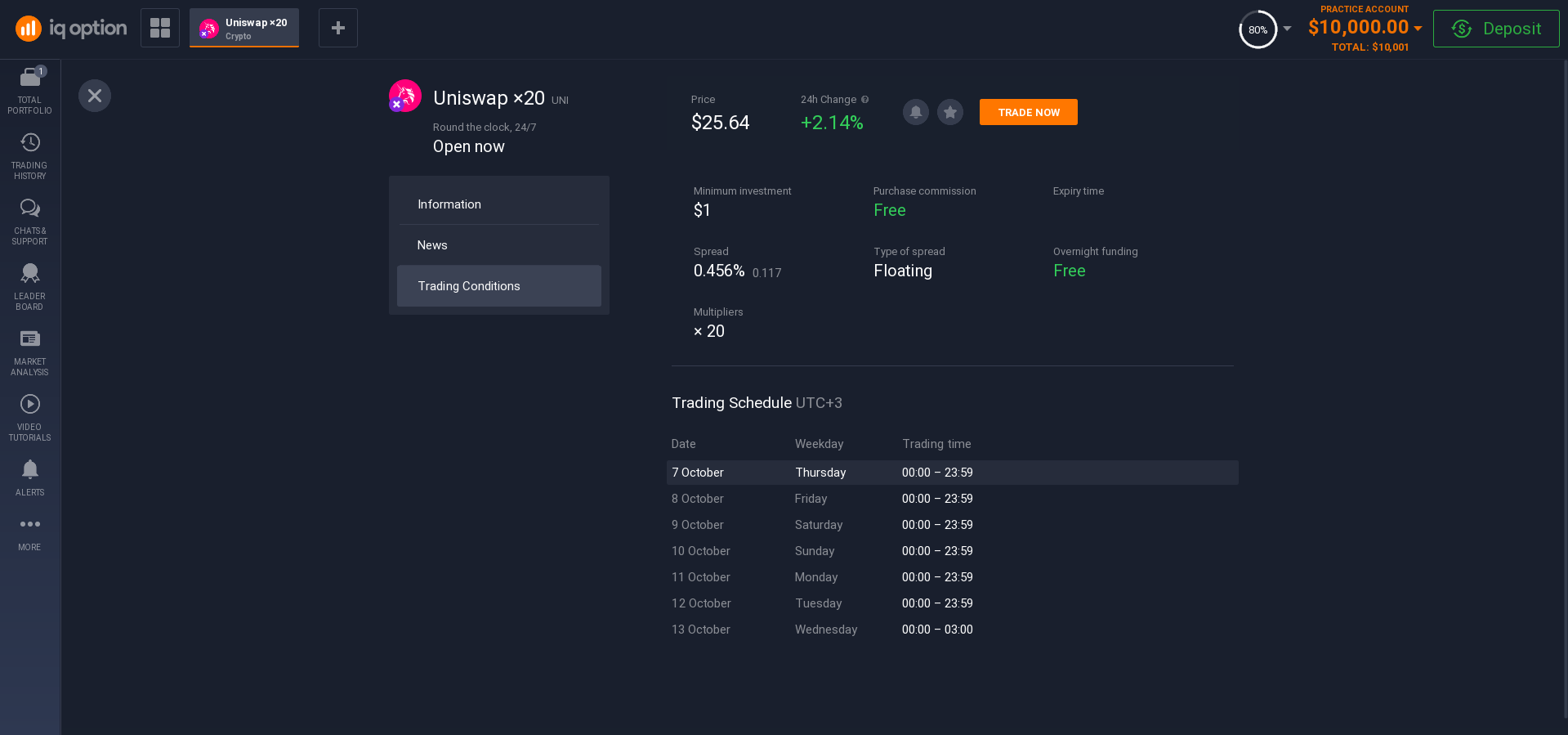

In addition, Uniswap smart contracts have been audited several times, as confirmed by published audit reports from the platform. The Uniswap exchange design allows easy and quick access to new tokens. Compared to centralised exchanges, the platform offers lower commissions of 0.3% per transaction than the usual 0.5%.

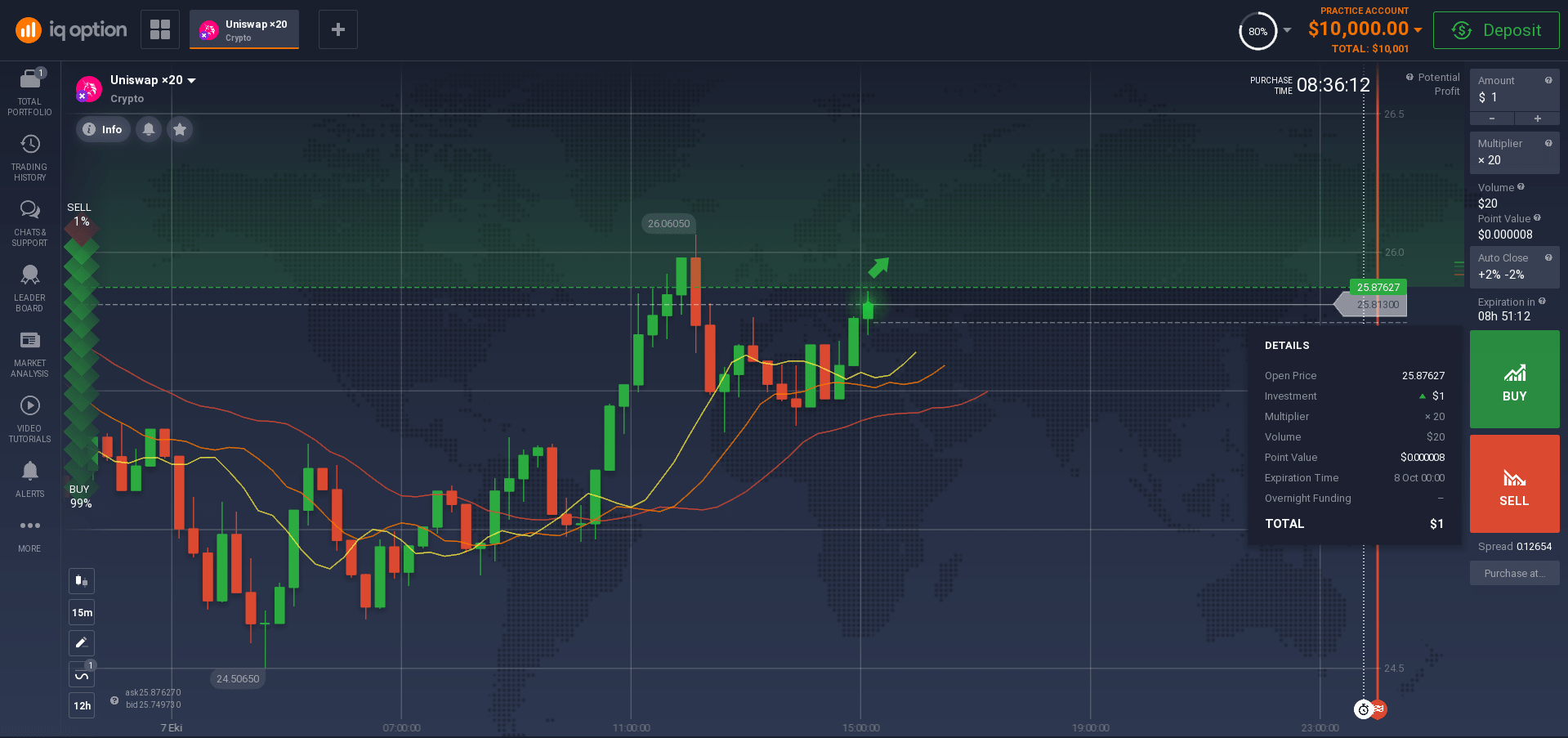

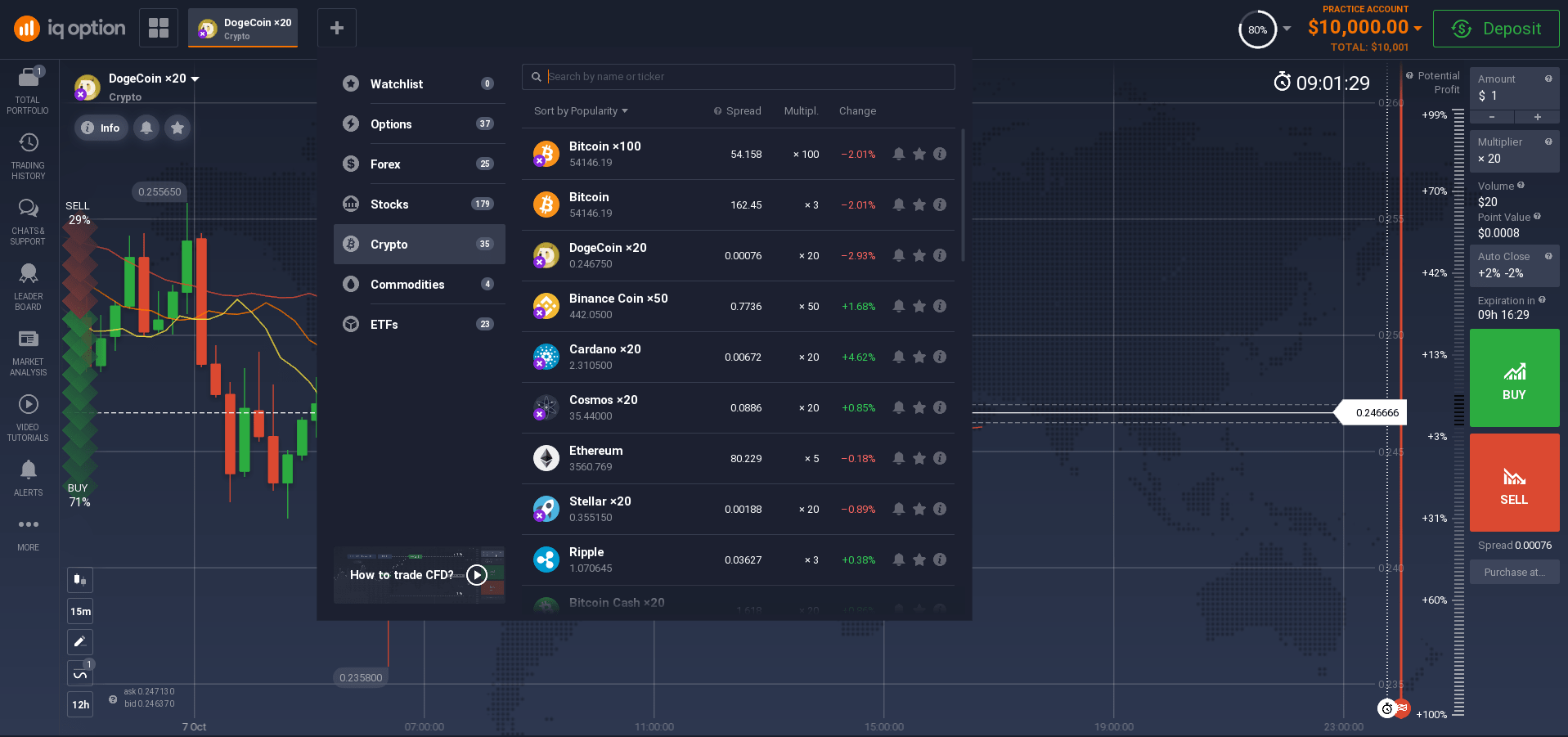

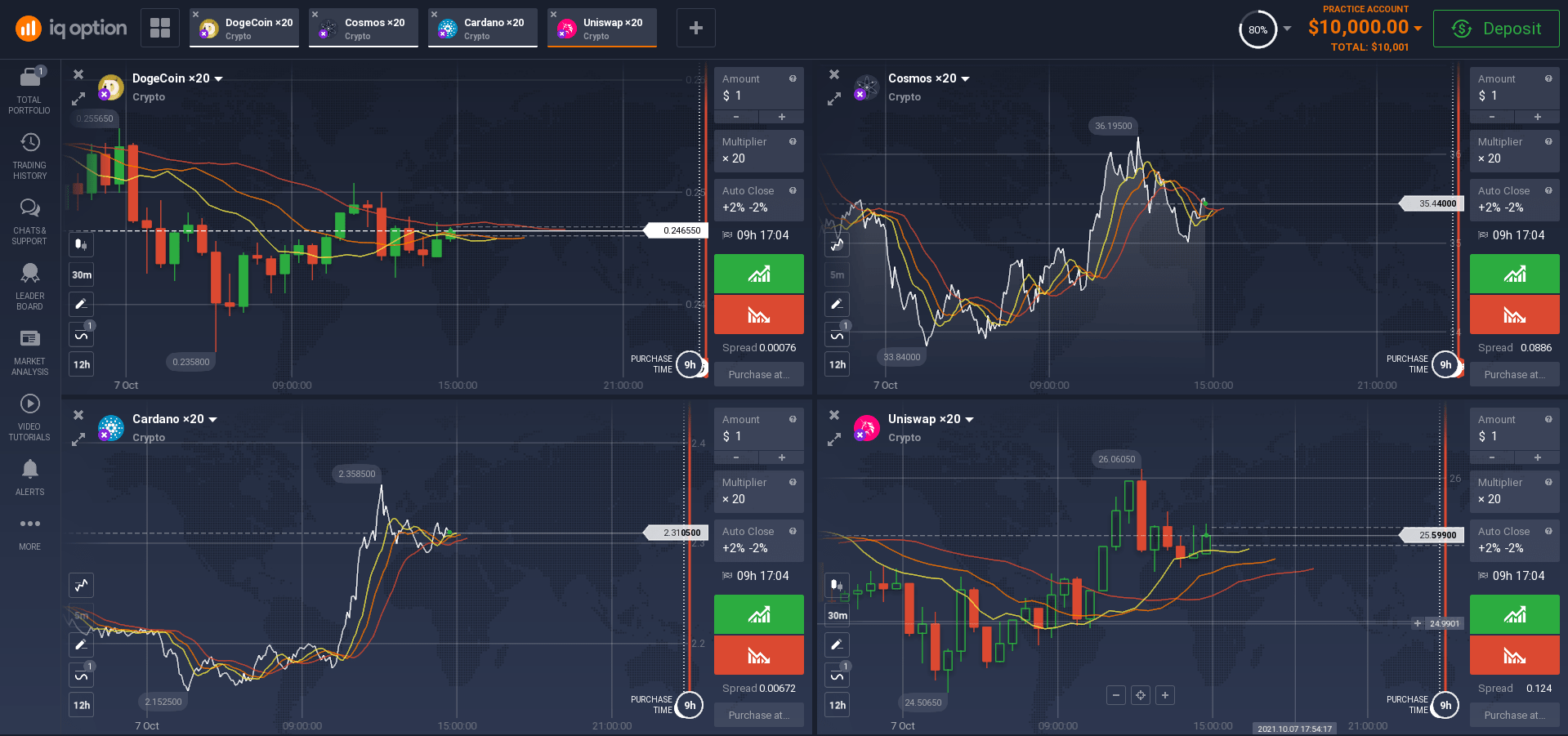

How to invest in Uniswap in the UAE?

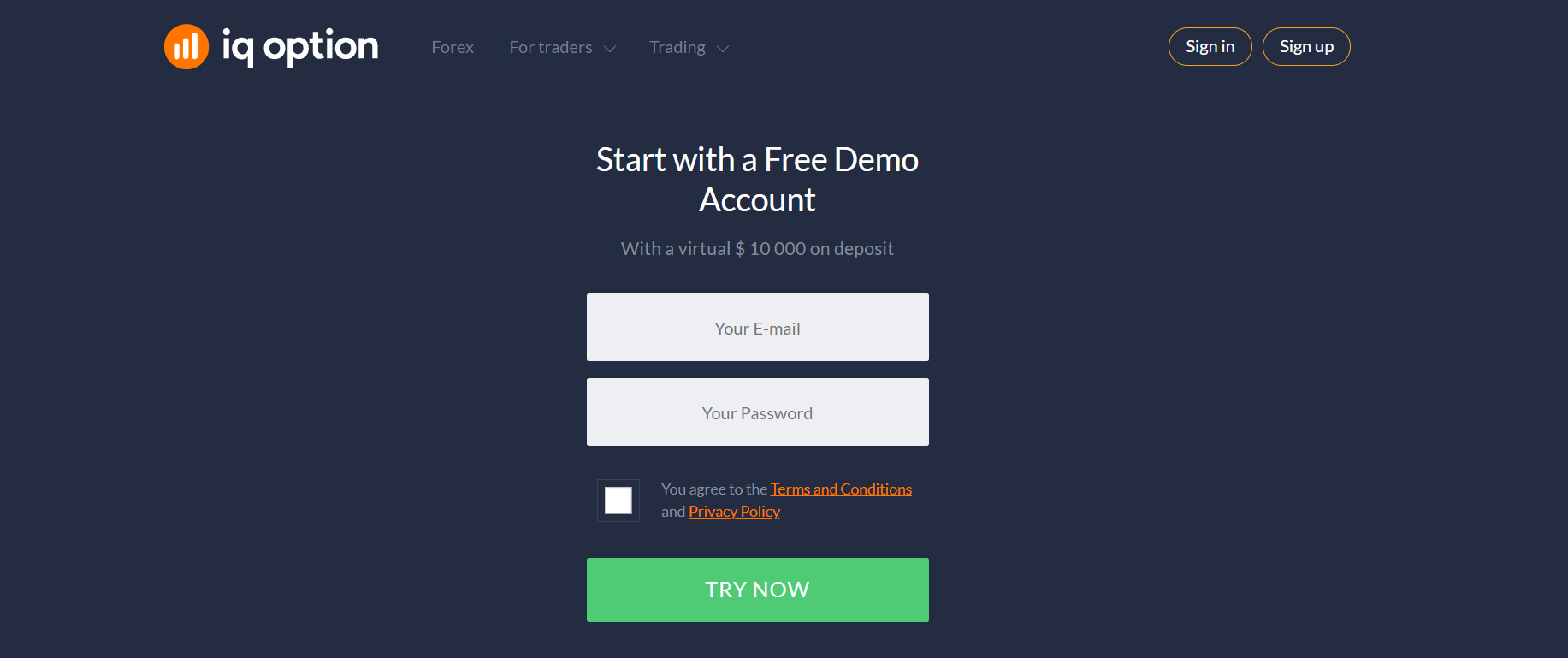

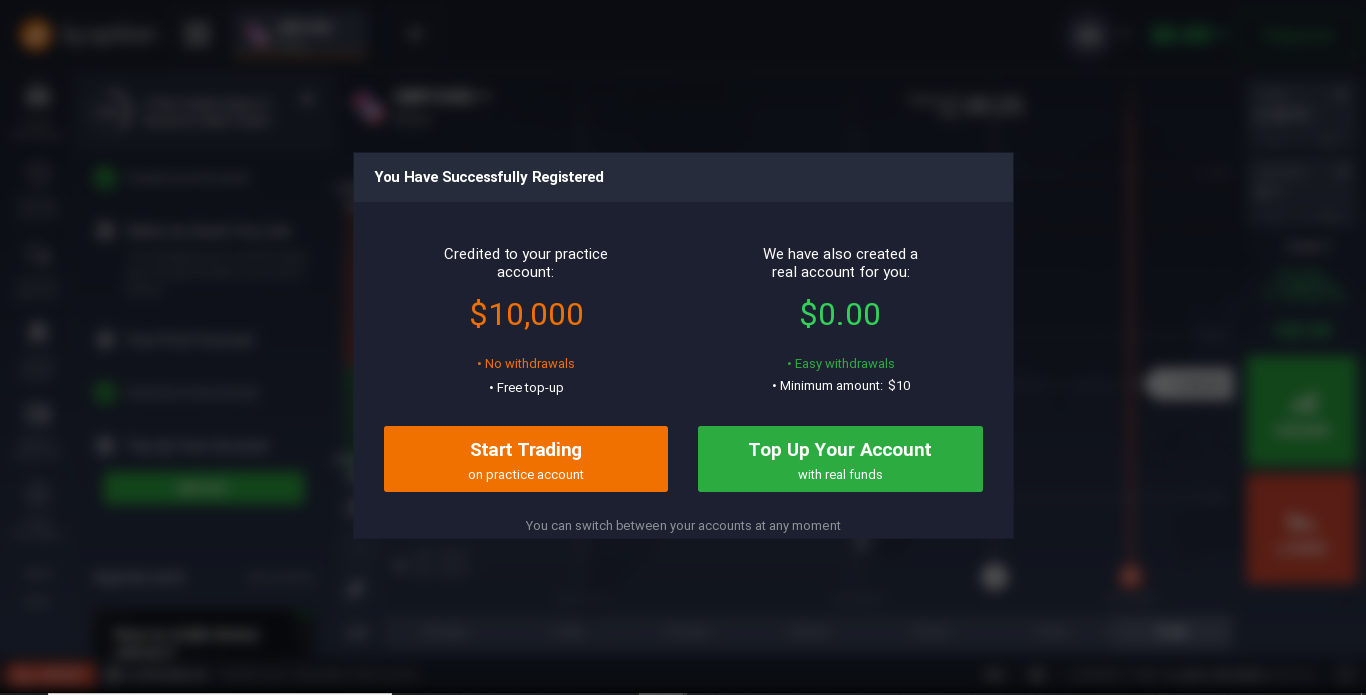

Registration and Demo Account

If you feel the urge to buy Uniswap in UAE, you need to register. Registration is mandatory for all platforms. This step is necessary because the platform must recognise its clients. After registering, you will be able to use the demo account. In addition, you will be able to gain experience and trade with virtual money.

Real account

Do you have a willingness to invest in Uniswap in UAE? Do you feel hunger for new achievements? Then, open a real account making a minimum deposit and start your trading career!

Bottom line

The decentralised exchange Uniswap has advantages and disadvantages. The platform's steady growth in trading volume indicates that its benefits outweigh its disadvantages. That’s why many people around the world aim to invest in Uniswap. Despite this, it is vital to be aware of possible risks before starting to trade on Uniswap. Believe in yourself!