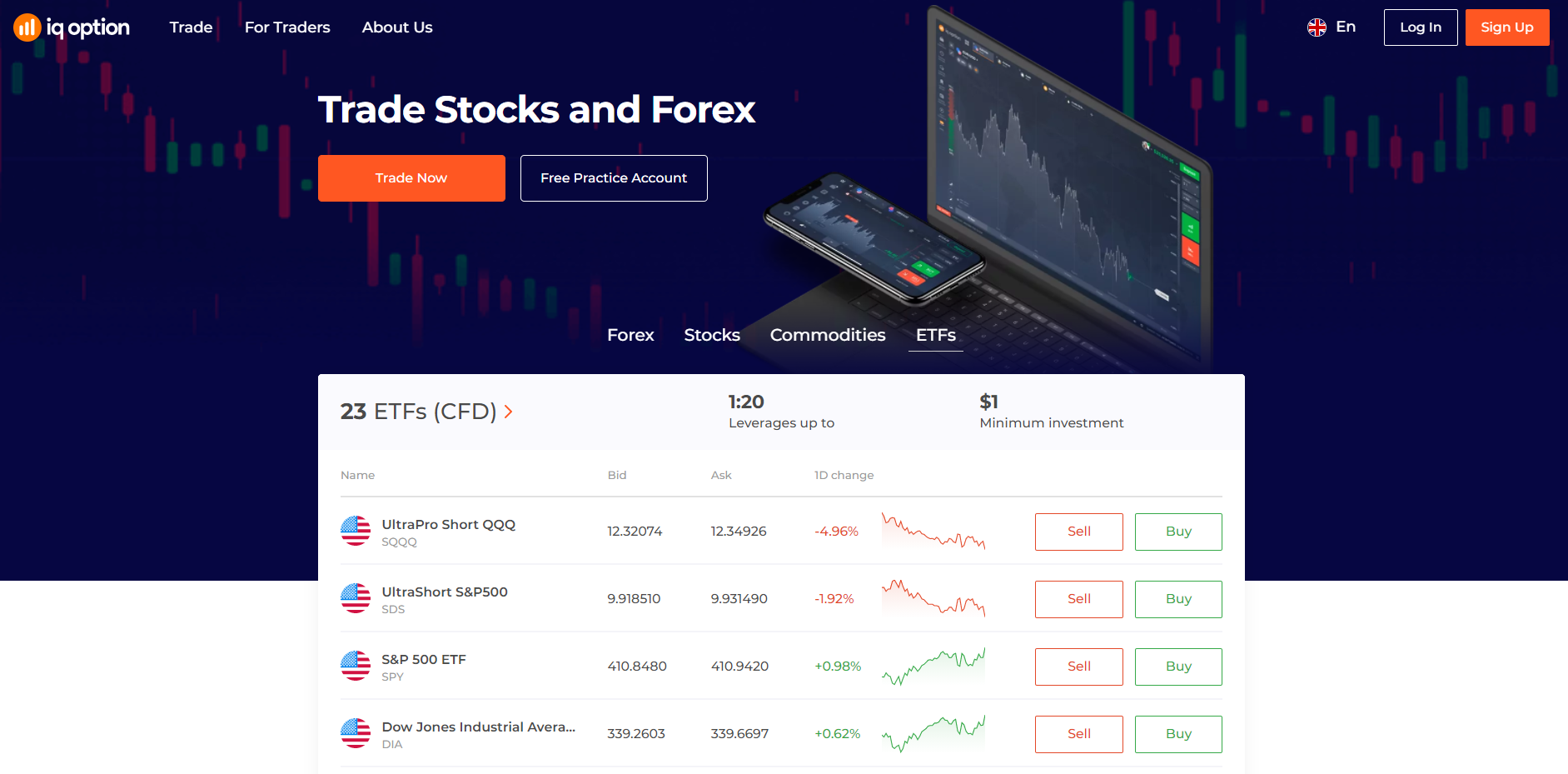

ETF trading platform in the UAE

You can invest online using various financial instruments. One of the possible investment options is investing money not in individual stocks, but in funds. Nowadays there are a huge number of different funds, which opens up many investment opportunities for us. To invest in ETFs, you first need to understand how it works.

Below we will take a closer look at what ETF trading is, and also note what functions a trading platform should have for ETF trading in the UAE.

ETF: features of a financial instrument

ETF - Exchange Traded Funds, a type of securities that are traded on stock exchanges in a similar way to stock trading.

ETFs first appeared as a financial instrument in 1993. They are registered investment products that track the performance of a group or "basket" of stocks, bonds or commodities. These "curves" are known as indices. In other words, an ETF tracks the performance of its underlying basket of assets, such as stocks, commodities, bonds, or a specific market index. One ETF is one of various Exchange Traded Products (ETP), the other is Commodities (ETC) and Exchange Traded Notes (ETN).

Simply put, an ETF is a “basket of stocks,” meaning an investment fund that tracks the value of an index and trades like a single security. The growth in the value of shares of an investment fund indicates its success and prospects. The funds themselves can buy shares and other listed assets.

A stock market investment fund is a ready-made portfolio that can reflect a specific stock market index or can have a real portfolio of stocks or metals or other commodities, for example.

Today, almost every stock index has an ETF that mimics its structure.

Investing in ETFs in the UAE

ETF shares are traded on the stock exchange like ordinary shares. Some cost a few cents, the most expensive hundreds of dollars.

In order to invest in ETFs in the UAE, you need to find a reliable broker who works with funds.

Finding a broker is not difficult. There are many brokerage offerings in the South African market. Of course, a reliable broker must be licensed to conduct brokerage activities. Choose only licensed companies. Study the activities of the selected brokers, reviews of these brokerage companies, check the amount of commissions and the quality of the online platform for work.

Today there are about 6,000 ETFs. You can invest in company stocks, commodities or real estate, or choose the currency market.

Your share in the ETF you invest will reflect the dynamics of the fund's asset value. One share is a projection of the entire portfolio, but each individual investor receives income from the fund equal to the amount of money contributed (purchased fund shares).

ETF classification

ETFs can track different assets or groups of them, for example:

- Indices;

- A basket of company shares;

- Bond basket;

- Commodities;

- Currency market.

ETFs are classified according to various criteria:

- ETF by economic sector. This may include construction funds, biotechnology funds, oil and gas companies, banks and financial services, metallurgy and mining, electricity, energy, pharmaceuticals, retail, and others;

- Bond ETFs;

- Commodity ETFs. These are precious metals, oil, real estate;

- ETF by management style. For example, growth stock ETFs, high dividend ETFs, undervalued stock ETFs, and so on;

- ETF by capitalization;

- ETF by region (- ETF US, ETF Australia, ETF Canada, ETF Europe, ETF Japan, ETF emerging markets.

Once you've selected a reputable broker, ask which ETFs they offer access to. Register on the broker's trading platform, open an account and start trading.

Choosing a platform for ETF trading

To choose a good platform for trading ETFs in the UAE, please study the following points:

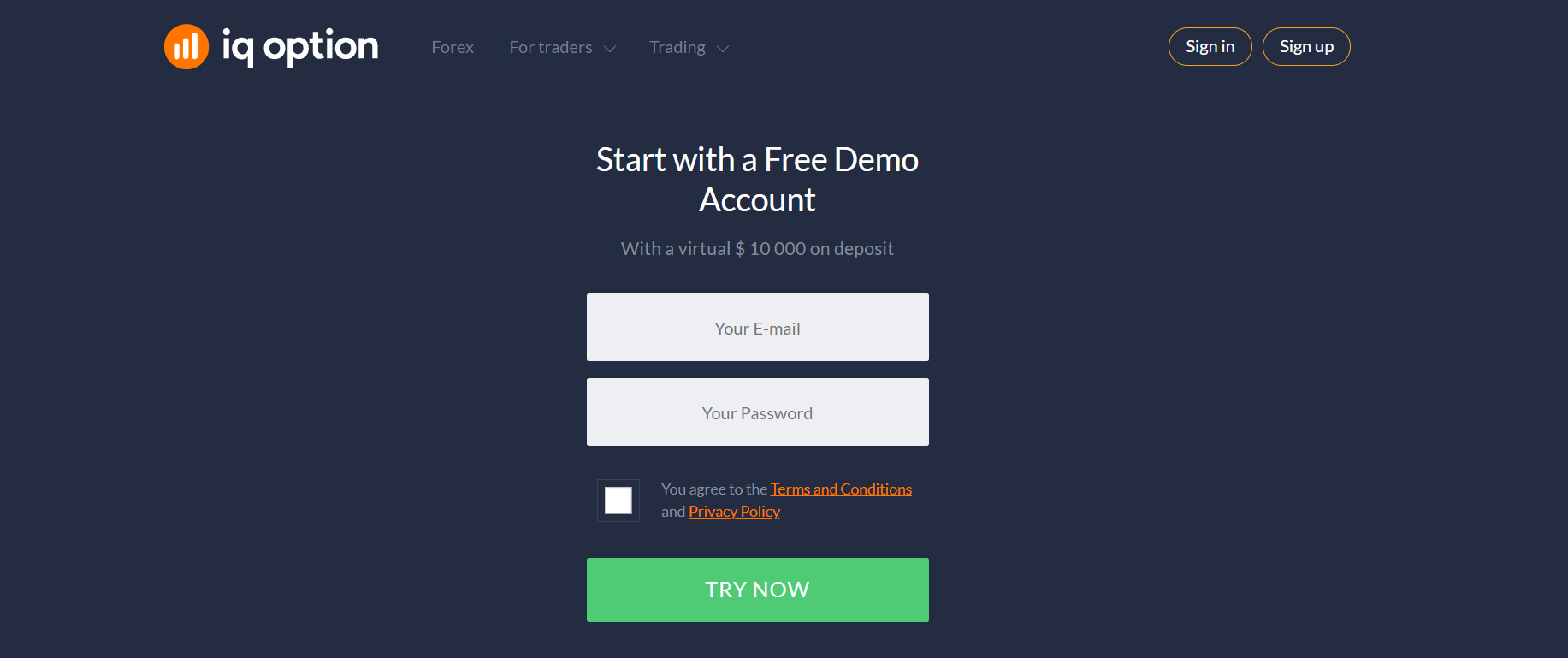

- How to register? Registration on the platform should be simple and fast.

- How to replenish an account and withdraw funds? Modern platforms offer several deposit and withdrawal options - see if they are right for you.

- Operation limits. Each platform sets its own limits on operations - when choosing a platform for work, it is important to study them in order to avoid inconvenience in subsequent work.

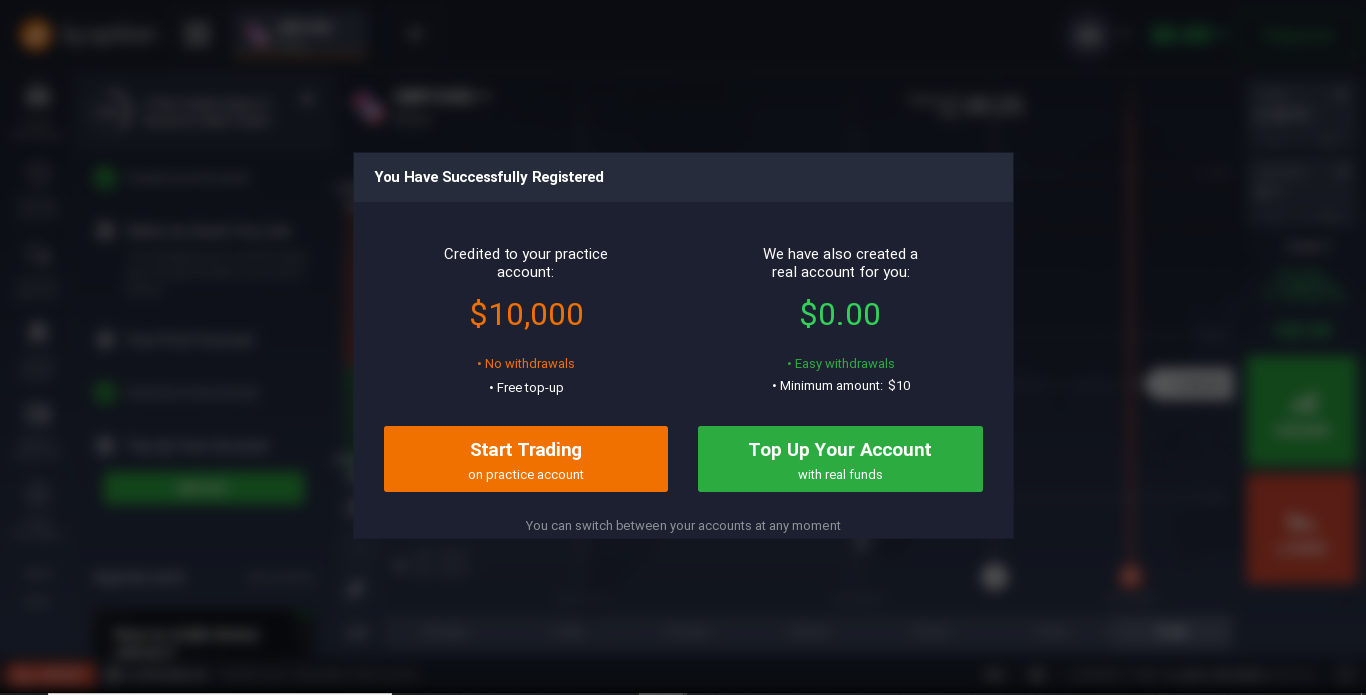

- A presence of a demo account. Most platforms offer to start working with a demo version of the account, which allows you to work with a fictitious amount for training.

- Training. The best trading platforms contain a "Learning" section with lessons - opt for one of these platforms.

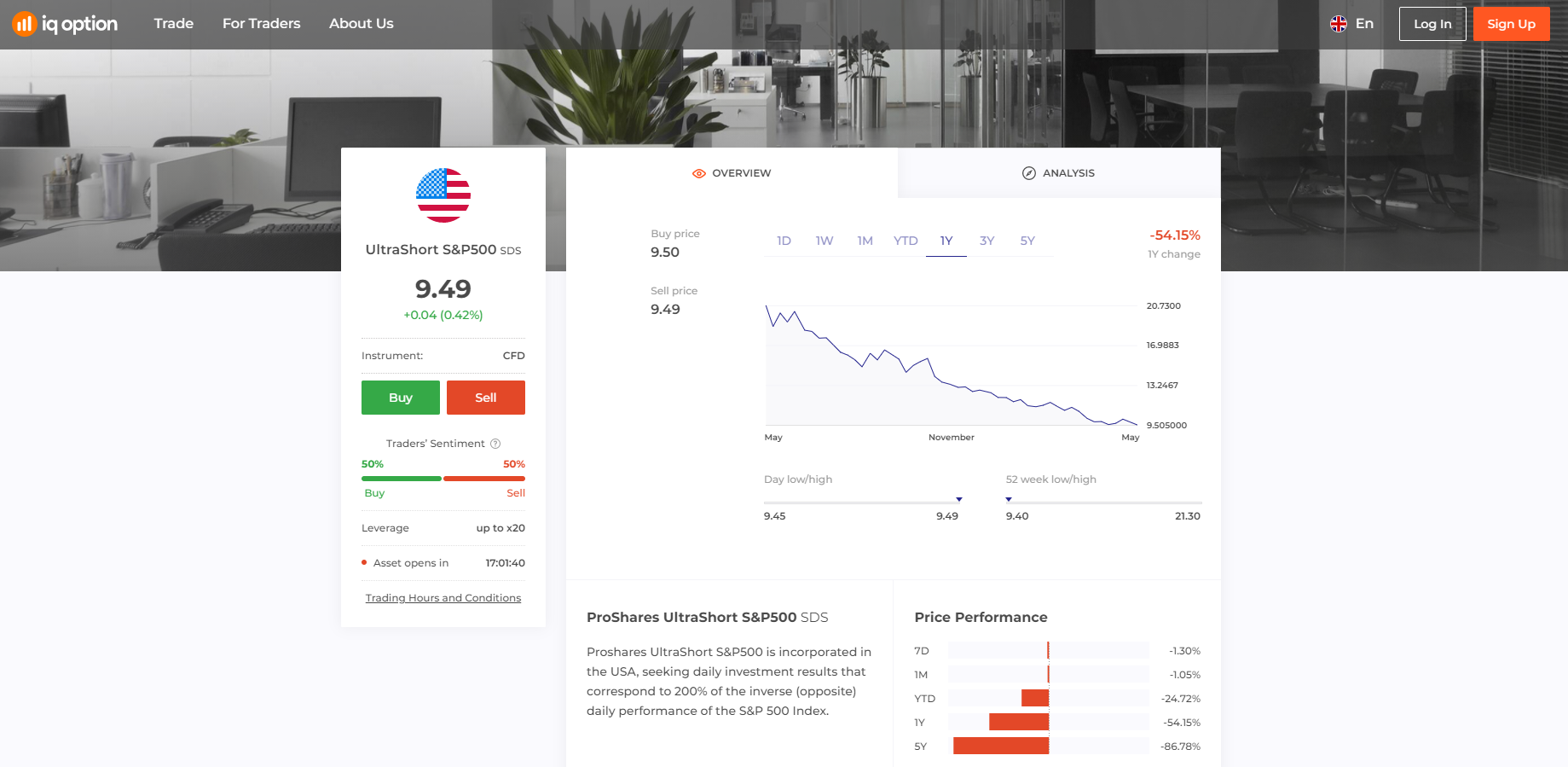

- Informativeness. The platform should contain at least brief information about assets (price, trading schedule, statistics for the last time) so that you do not waste time searching for the necessary information on external sources.

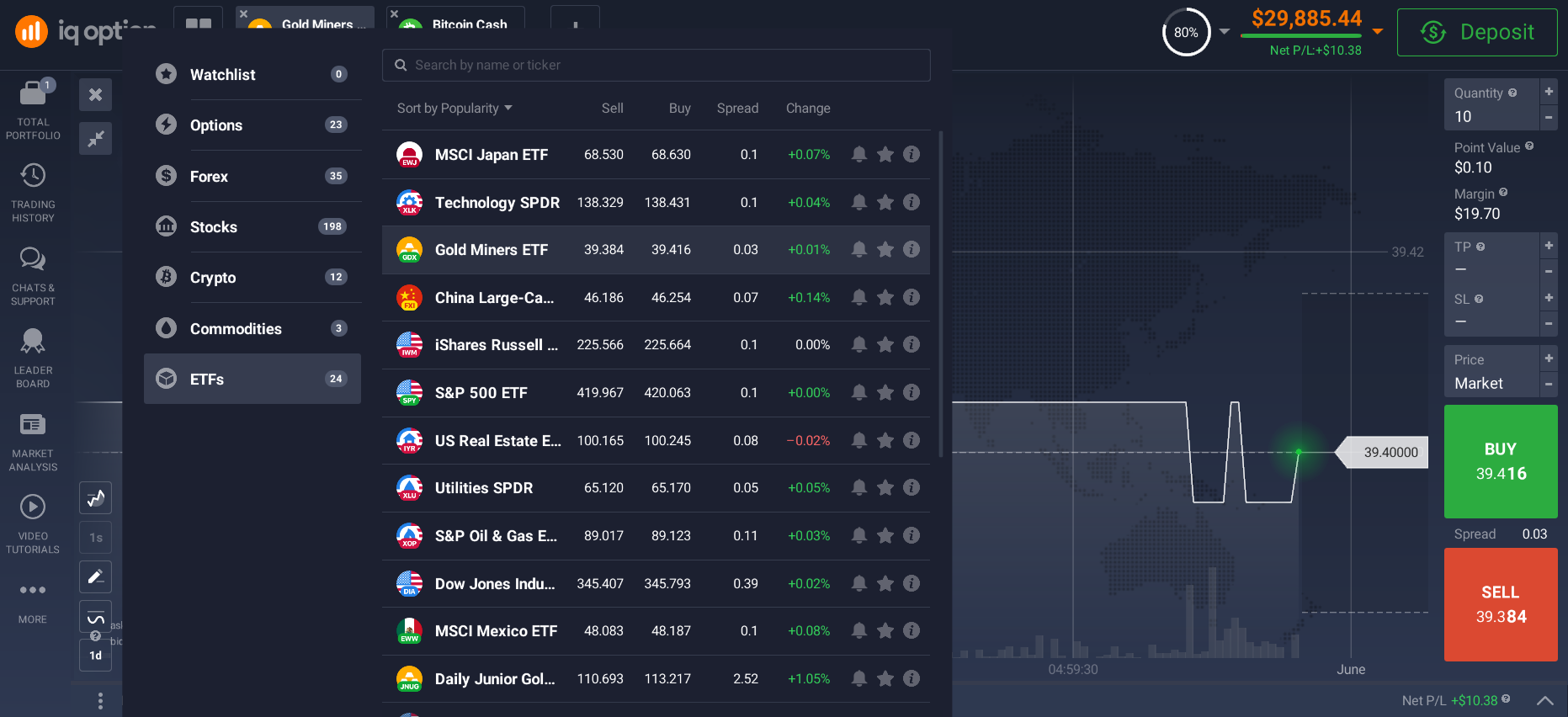

- ETF instruments. Of course, if investing in ETFs is your goal, the platform should provide access to these financial instruments, in particular, to the selected specific ETF.

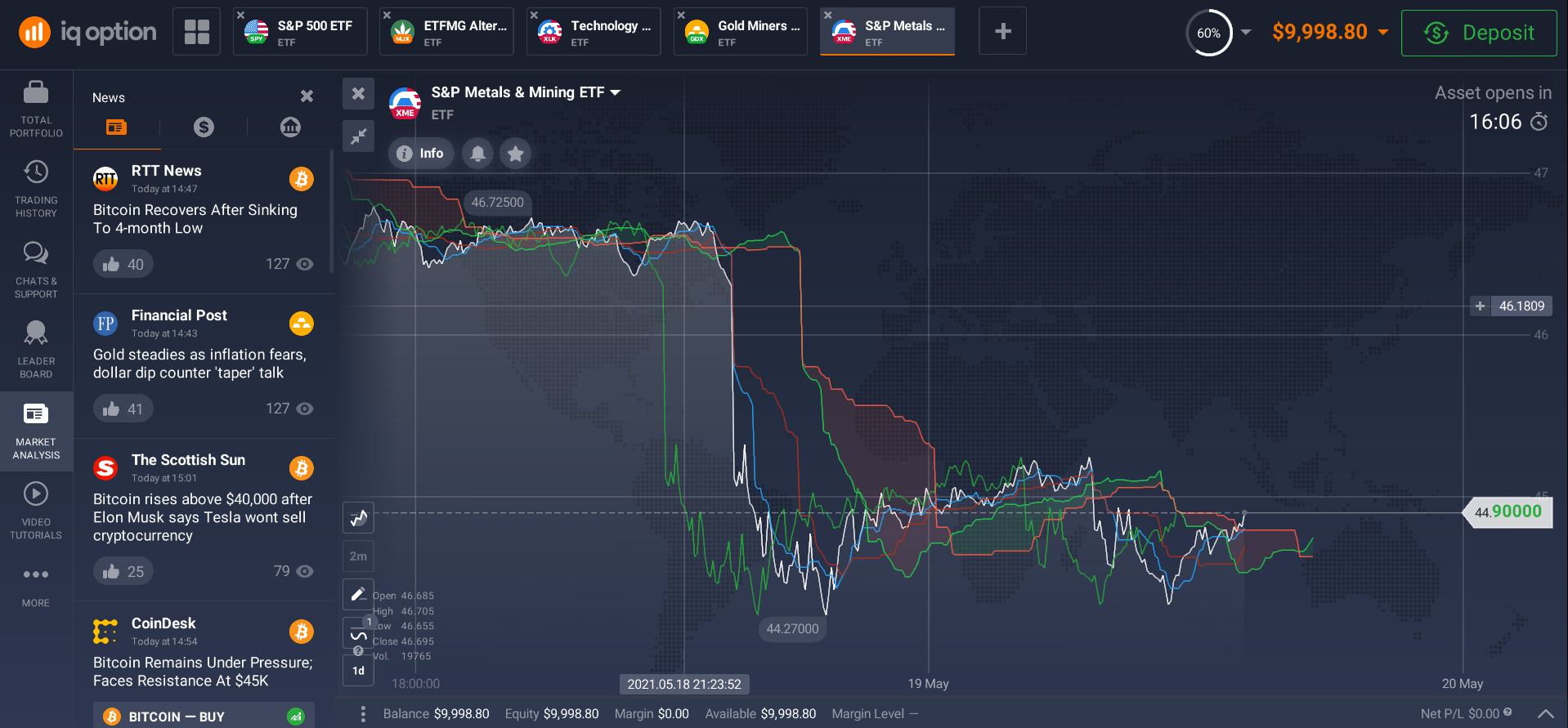

ETF trading platforms in the UAE are modern innovative programs, which often also have a mobile version. The platforms are easy to sign up for and easy to deposit and withdraw funds. You can choose a platform with low transaction limits and no fees for most services. The opportunity to learn how to trade on a free demo account, as well as access to a series of free video tutorials on trading - these features will help you easily learn all the intricacies of ETF trading. You will also be able to view the latest stock market news and current price feed.

A brief overview of a specific fund will help you navigate your choice. Check out the analysis offered on the platform, study the statistics.

Thanks to the information content of modern trading platforms, you can easily decide on the choice of a suitable ETF for investment.

Explore the trading floor of the platform - do you understand the interface? Here you will see the chart of the asset price movement and all the necessary options for trading: the "buy" and "sell" buttons, the "multiplier", the tab with indicators, and so on. Thanks to the flexible settings of the platform, you can display the parameters you need right on the screen of the trading room. For example, you can customize the display of the news feed in the left sidebar so that you don't miss any news that interests you. Or, conversely, remove the news feed from the trading screen if it distracts you. You can customize the windows to your liking, viewing multiple charts at the same time if necessary. You can reorder and resize work windows on your computer screen by simply dragging and dropping them. You can change the themes of the working window of the platform, as well as change the color palette of charts and indicators according to your preferences.

Registration on the ETF trading platform

Signing up on most platforms is very easy. Visit the website of the selected broker, click the "register" button, the system will redirect you to the registration page. Fill out a simple registration form, tick the plus mark in the Agreement on Terms and Conditions and Privacy Policy and confirm the registration using the standard procedure using your email and following the platform prompts.

Demo account

A demo account is probably the most important thing to consider when choosing a trading platform. With a demo account, you can get to know the platform and learn and hone your trading skills. On your demo account, you will have access to fictitious funds that you can use for trial operations. Of course, you will not be able to withdraw this amount, but you do not need to return this money if it turns out that the operation was unsuccessful. That is, you can study without losing real money. When you have enough experience, open a live account and start real trading.

Real account transactions

A real account implies working with real money and real trading. Here you need to be careful and attentive, as you will lose real money if the transaction is unsuccessful. Start trading with small amounts so as not to take risks, while you do not have enough experience. Experienced investors recommend spending no more than 10% of the available funds to begin with. Let your investment grow with your experience. Online trading is a risky business and you must keep this in mind. Activate your real account by funding it with real money. You can make a deposit directly from the platform by clicking the "deposit" button and choosing one of the payment methods. The most popular method among traders is replenishment with a bank card, it is quick and convenient. However, you can also use one of the online payment systems offered by the platform. You will be credited instantly, regardless of the funding method you choose. Withdrawals can be made using the same tools.

ETF trading platform tools

Modern platforms offer trading tools that can simplify the trading process and also help protect your trades to a certain extent. The most popular trading tools among traders include stop loss and take profit.

Stop Loss and Take Profit are types of automatic stop orders or stop orders, which are designed to restrict trading in the event of certain conditions predetermined by the trader.

Stop losses do not allow you to track price changes in real time, which is convenient for conservative investors who do not want to spend a lot of time constantly monitoring changes in their portfolio. Stop losses are not limited in time, i.e. they will act until they are triggered.

Pros and cons of ETF trading

There is no doubt that ETFs are a great financial instrument. However, ETF trading has its pros and cons.

The advantages include the following points:

- Diversification: Investors can own tens, hundreds or even thousands of securities in one ETF. By owning multiple stocks, you can reduce the volatility of your portfolio compared to buying one or more securities.

- Low fees: Most ETFs are passively managed, so they do not require large fees for maintaining, researching or maintaining a large staff of analysts.

- Trading on the exchange: ETFs can be bought and sold during the trading session on the exchange. Since it is an exchange instrument, you can place various orders - limit, market, stop loss, etc.

Disadvantages of ETF trading:

- Trading costs: in addition to the commission for managing the fund itself, you will have to pay the broker a commission for the exchange transaction.

- Narrow niche ETFs: This is a contingent drawback as some ETFs are narrowly focused and therefore can be more risky than funds that follow broad indices.

- Spreads: You usually buy ETFs with a small spread over NAV (Net Asset Value).

To see firsthand the advantages and disadvantages of this type of trading, open a free demo account and try ETF trading in practice. It can be a financial instrument that will become your main asset in online trading.