Characteristics of the currency pair EURUSD

When starting as a trader, every beginner must first decide what and how to trade. You can make this choice based on your goals, budget and personal preferences. To help you understand how to begin trading, let's start with one of the most popular options, trading currency pairs.

What are currency pairs?

The goal of a financial trader is to profit from speculating on price movements. Two currencies are called a currency pair. This is a relative value expressed in terms of how much the first currency is worth per the second currency.

A currency pair is a ratio of the prices of two currencies. The term is often used when it comes to trading in the forex market, where the trader always buys one currency and sells the other. The first currency in a pair is called the base currency and the second is called the quote currency.

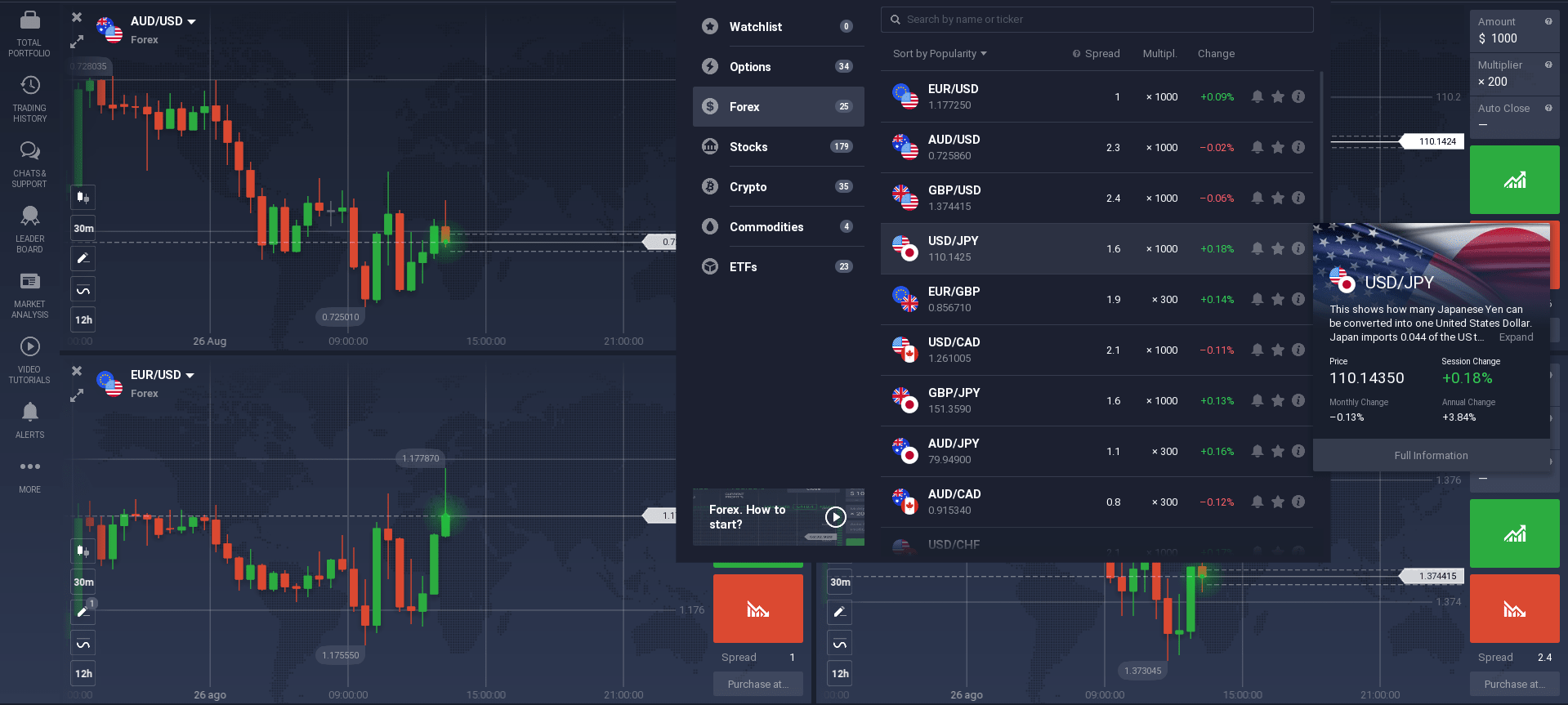

If you want to learn more about forex trading online, you should first become familiar with the major currency pairs.

The forex market is the most liquid in the world. It is worth reminding ourselves that the greater the value of trade between two countries, the more liquid the currency pair of those countries will be. EUR/USD is the most liquid currency pair in the Forex market.

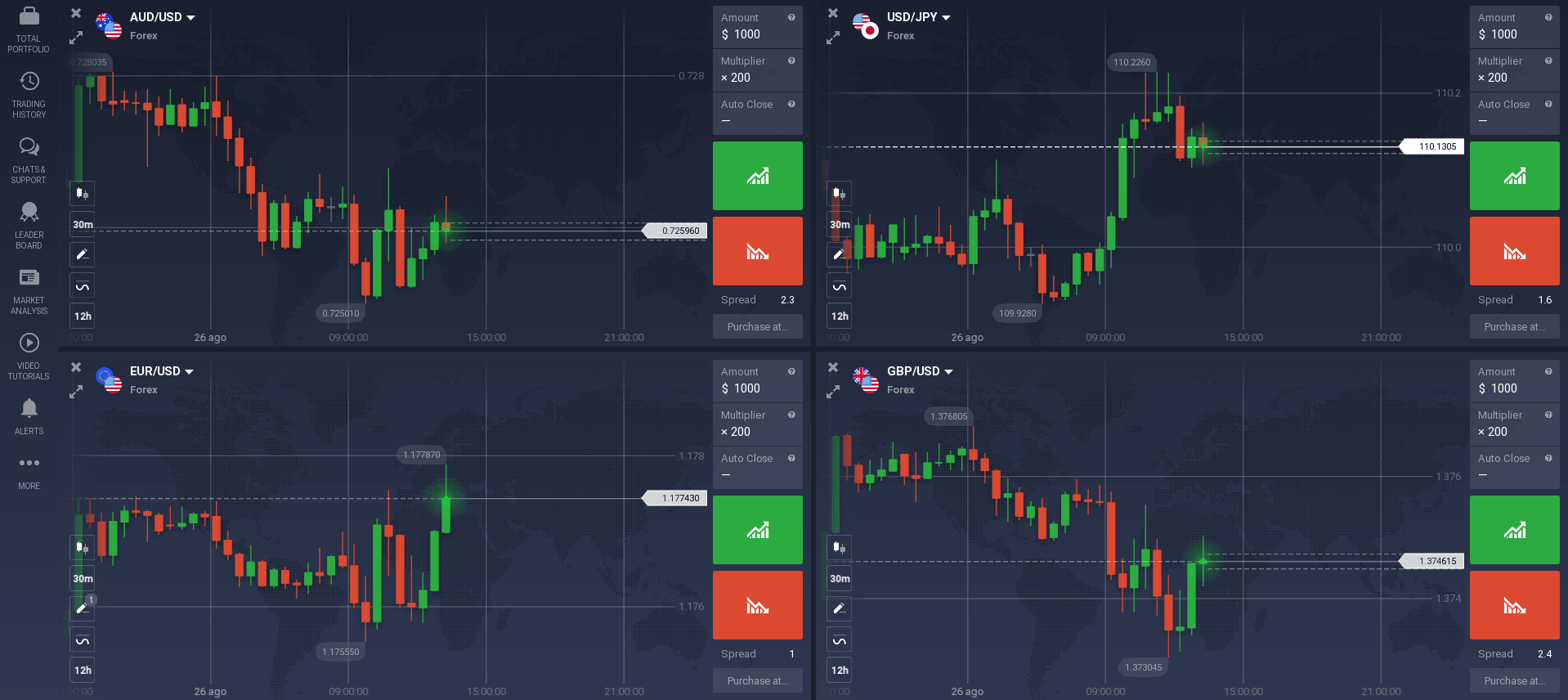

Major currency pairs are the most popular pairs. There is no formal list defining major currency pairs or the best currency pairs. But when we speak of major pairs we are usually referring to the six most actively-traded Forex pairs:

- AUD / USD Australian/US Dollar.

- EUR / USD Euro / USD.

- GBP / USD British Pound / US Dollar.

- USD / CAD US Dollar / Canadian Dollar.

- USD / CHF US Dollar / Swiss Franc.

- USD/JPY US Dollar/Japanese Yen.

Unsurprisingly, the currencies of the world's significant economies make up these major Forex pairs.

Another reason is the political and economic stability historically associated with these currencies. This increases their attractiveness, especially in times of economic uncertainty. The USD is particularly popular. The USD is supported by its status as a reserve currency for central banks around the world, and many key commodities (e.g. oil) are priced in USD.

The euro is the most commonly used currency after the USD (both by institutions and governments).

Currency prices

The exchange rate is the value of one country's currency in other countries' currencies. It determines, for example, how much a euro is worth to a dollar or yen.

What influences exchange rates?

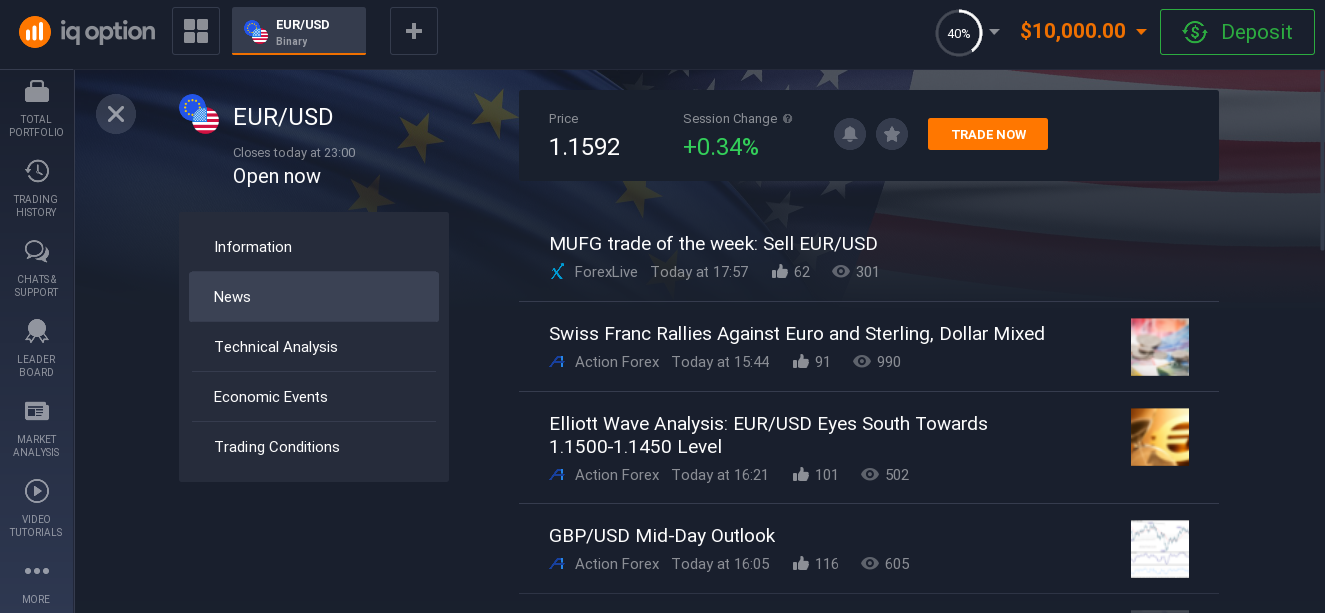

- First and foremost, currency rates are affected by macroeconomic data. A forex trader should always monitor the international economic news and current statistics, such as political developments, the outcome of central bank meetings, recent unemployment figures, inflation rates, etc.

- Also, the degree to which the central bank of a country is involved in the local economy to control the money supply and the general market sentiment, can cause significant price movements. Without a fundamental analysis and constant monitoring of this data, your chances of making a successful trade are nil. For the convenience of traders, there are special macroeconomic calendars, which make it much easier to navigate through the flood of information. They contain the most important events that can influence the quotes.

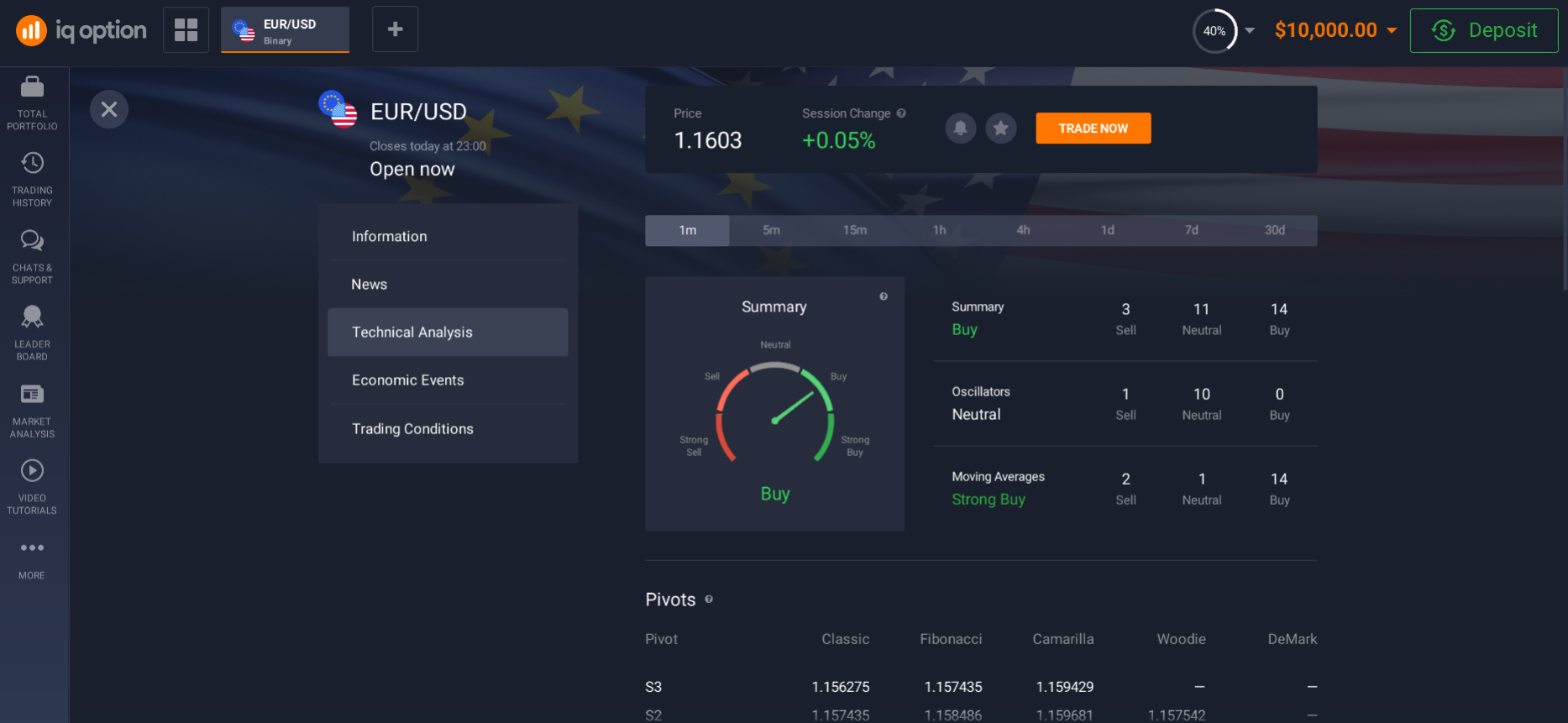

- Another indispensable ally of the forex trader is technical analysis. The technical analysis is based on the analysis of the price chart of the currency pair being traded. The principles are the same as for trading on the stock market. Wave analysis, indicators and chart patterns should be your best friends and mentors in making decisions.

For best results, we suggest using both fundamental analyses of significant economic events and technical chart analysis.

Trading sessions

Time of day trading is critical as different currency pairs are liquid at other times of the day, their volatility varies, and the trading style varies from calm to aggressive.

So, let's find out what a trading session is and why it is so essential for successful trading.

A trading session is a period of transactions between market participants in the same time zone.

The forex market is available 24 hours a day. Banks and traders operate in different time zones, so when trading stops on one side of the world, traders join in on the other.

The Forex market never sleeps - except on weekends and public holidays. After the weekend break, there is a sharp price movement. You can predict its direction by analyzing the news on Friday and the weekend. At the same time, the time before market closing and on Monday immediately after the opening are considered the riskiest and unpredictable due to price gaps. There is even a term known as gap trading.

In some periods of the day, sessions overlap and trading becomes more active.

Trading session times

The following trading sessions are present in Forex:

- Pacific 20:00 - 07:00 UTC;

- Asian 23:00 - 09:00 UTC;

- European 07:00 - 17:00 UTC;

- American 13:00 - 23:00 UTC.

Most activity takes place during those periods when market opening and closing times "overlap". The highest activity tends to occur when London closes, and Wall Street opens. The quietest and least volatile period is Australian and Asian sessions.

It is worth noting that the highest physical concentration of forex trading occurs in London, which accounts for over 1/3 of total volume, and also in New York, which accounts for almost 1/5 of all trading (to be more precise, about 33.3% of trading volume occurs in London, and about 20% in New York).

Every trader, of course, chooses the period of forex trading sessions depending on their location. According to this factor, a retail trader has to adapt to the volatility, so choosing suitable trading systems is essential.

As a rule, a beginner is attracted to the American session because it has the highest volatility. But do not forget that with higher volatility, the risks increase. Therefore one should not immediately chase instruments with increased activity.

Pay close attention to the volatility of the currency.

When not to trade: applying the strategy for beginners

No system is 100% automatic - you will always be required to make some decisions, such as when not to trade.

A beginner's strategy helps you learn how to trade, but you should not think of a beginner's strategy as a way to get rich quick.

Trading involves risk; every time you enter into a trade, you must be aware that it will be profitable or unprofitable. However, as long as you stick to the rule of risking only 2% of your capital in an individual trade, you can protect it from a losing streak.

Any strategy with a set of rules can be profitable in some hands and unprofitable in others. The difference is in the traders themselves and how exactly the strategy is applied in the market. That's why you should always be personally involved in trading.

Most traders who have become successful will tell you that their best decisions were not the ones they decided to trade but the ones they chose not to trade. So let's break down when not to trade.

1. The price went out for R3 and S3.

Sometimes price moves above R3 or below S3. When the price moves above or below these levels, it becomes higher or lower than the average daily level. This means that we have had a meaningful buyer or seller pressure in the market, and it has caused the price to move out of these levels. In such situations, the price will most often stop as traders start to close their positions.

In such cases, the best choice is to refrain from trading and wait for the next day.

2. Using different currency pairs.

Price manoeuvres are the same regardless of the asset class. However, some subtleties to keep in mind as specific currency pairs can seriously affect your profitability.

For example, the spread on GBP/JPY is significantly higher than on EUR/USD. This means that if you target a specific pivot point that is a certain number of pips away from your entry point, you should consider the significantly higher spread on the GBP/JPY pair. In that case, the strategy is likely to be less profitable than when trading on EUR/USD.

3. Correlation of currencies.

It would help if you also remembered a correlation between currency pairs, which increases the risks. Currencies are most often traded in pairs, but you should not think of pairs as being isolated: if one pair's currency is rising in value, it is likely to increase in value against other currencies as well.

For example, if the price of, say, USD goes up against EUR, it is likely to increase against EUR and all other currencies. Thus, if the price of EURUSD goes up, it is expected that AUD/USD will also go up.

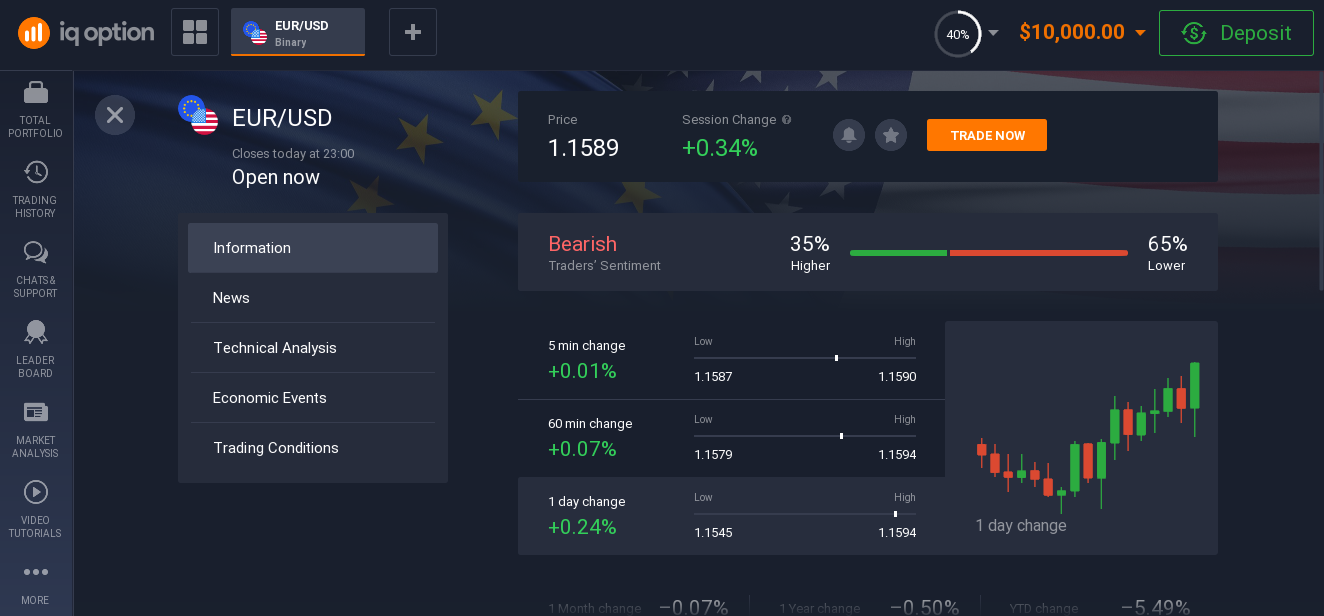

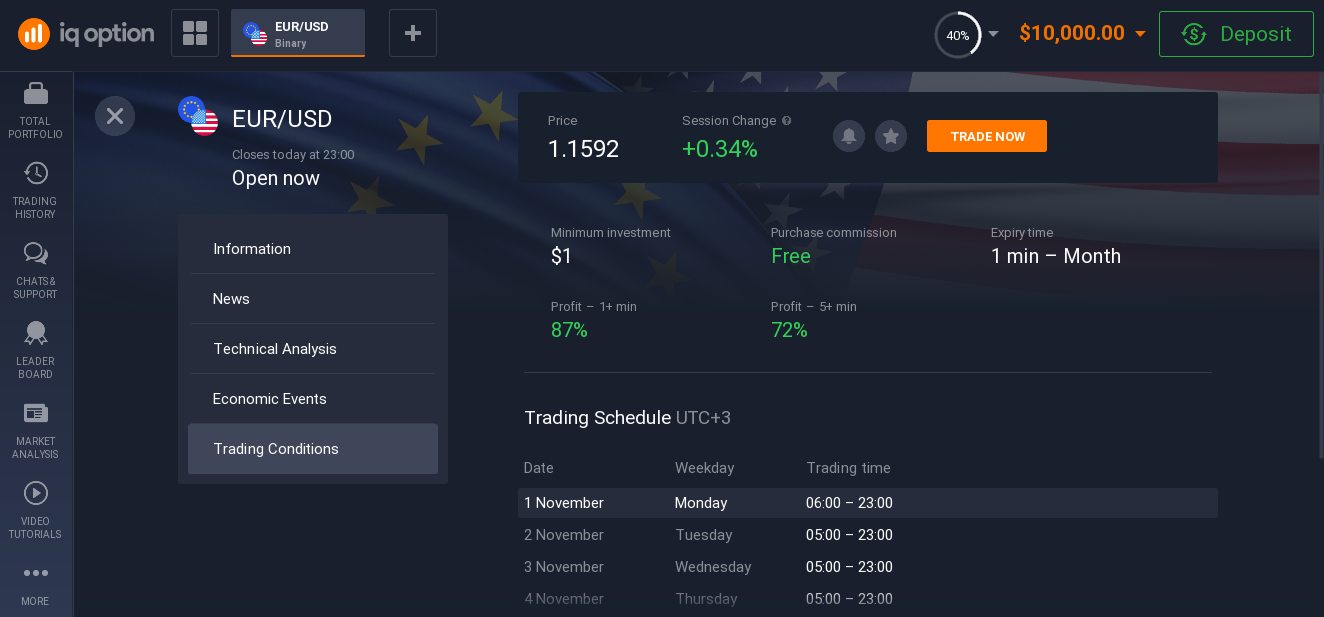

Features of the currency pair EURUSD

The EURUSD dollar currency pair is the most popular globally, accounting for 27.95% of total investment in the foreign exchange market in 2020. The pair represents the two largest economies in the world. It is high liquidity, and tight spreads are attractive factors for forex investments:

- Volatility (in pips per day): 48.63.

- Type: Major currency pair.

This currency pair has the highest liquidity - more than one-third of market transactions. This situation can be explained by the large scale and openness of the EU and US economies. It is characterized by high liquidity, which influences the profitability of transactions. Quote dynamics can be easily predicted based on graphical analysis.

Features of currency pair trading:

- All transactions on exchange rate differences are of the margin type. This means that each transaction is carried out only on the condition of a subsequent reverse transaction. If you buy an asset, you must sell it in the future. The currency does not become your personal property, and you have no right to dispose of it. Only the price difference between buying and selling an asset is at the trader's disposal.

- Another essential feature of trading currency pairs is the timing of operations. It usually depends on the opening hours of the major financial centres. The day on the Forex market is divided into different sessions. Experienced traders know that you should open and close deals in the American and European sessions, while the Asian session is less profitable, and the Pacific session is barely good.

- When choosing currency pairs as a trading instrument, one should also consider that they are often more volatile than stocks.

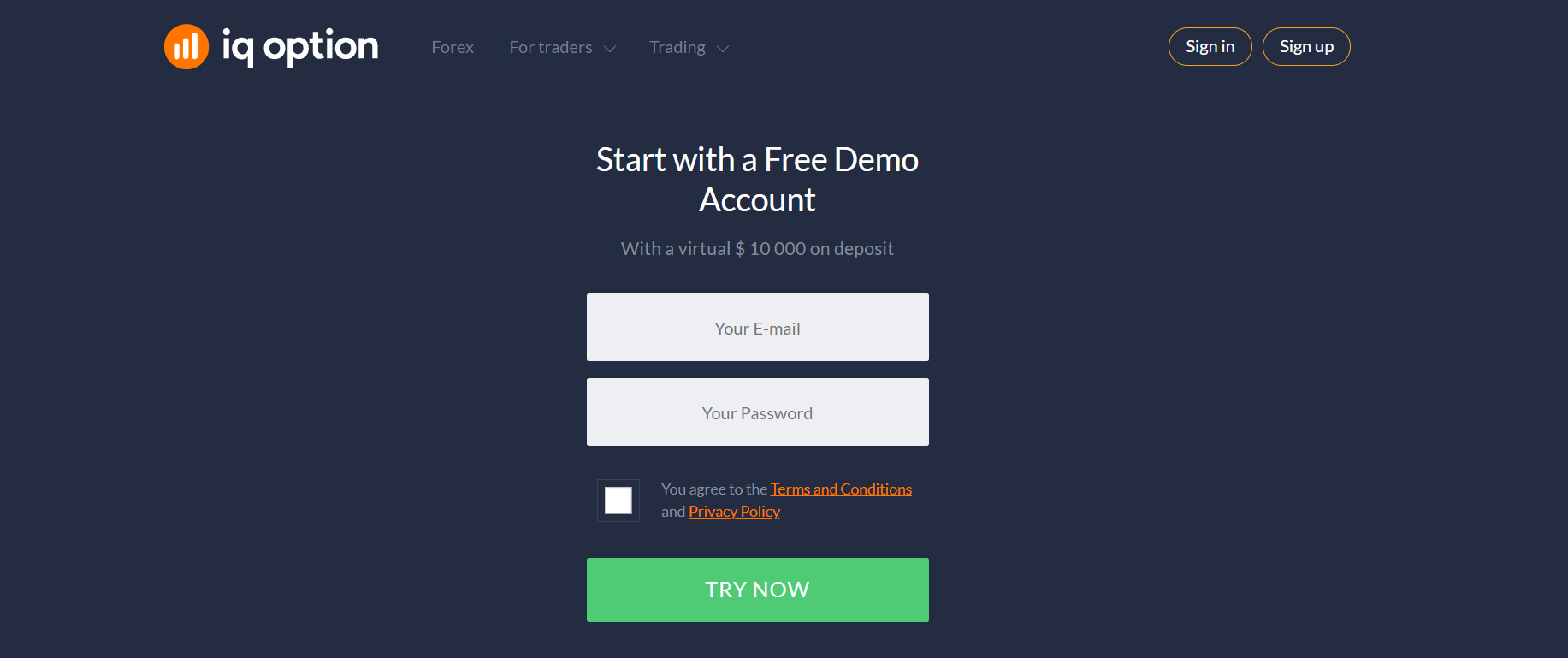

How to start trading EURUSD in the UAE?

The easiest way for individuals to trade Forex is to open an account with a reliable broker. The right broker allows you to play the currency market and invest in many other assets such as stocks, commodities and even cryptocurrencies.

- Register on the website of your chosen platform.

- Open a live account with a minimum deposit.

- Start trading as soon as you register.

So, to trade or not to trade, that's the question. The answer is up to you.

We wish you lots of luck in trading. You're going to get it!