Single stock trading strategy

A trading strategy is something without which it is impossible to work in the stock market in the UAE. Without a trading strategy, trading becomes a game of chance for adrenaline rather than profit. Therefore, the importance of trading strategy cannot be exaggerated.

What is stock trading

Stock exchange trading in the UAE. is the process of transferring ownership of shares and other securities on organized trading floors. The initial offering of shares allows the company to obtain funds for its operations.

Many factors can affect the price of a stock in the UAE, there are a few major ones that you should pay special attention to during your analysis. There are five most important factors that affect the price of any publicly traded stock. The market is forward-looking, so the price of a stock is a reflection of the future value of the company. Understanding these factors will help you react appropriately to price movements:

- important global economic and political news;

- reports from central banks and employment committees of the leading powers;

- fluctuations in the leading currencies;

- mergers, acquisitions, expansions, release of new models, increase in trading assortment, development of new directions by companies whose shares are in the trader's portfolio.

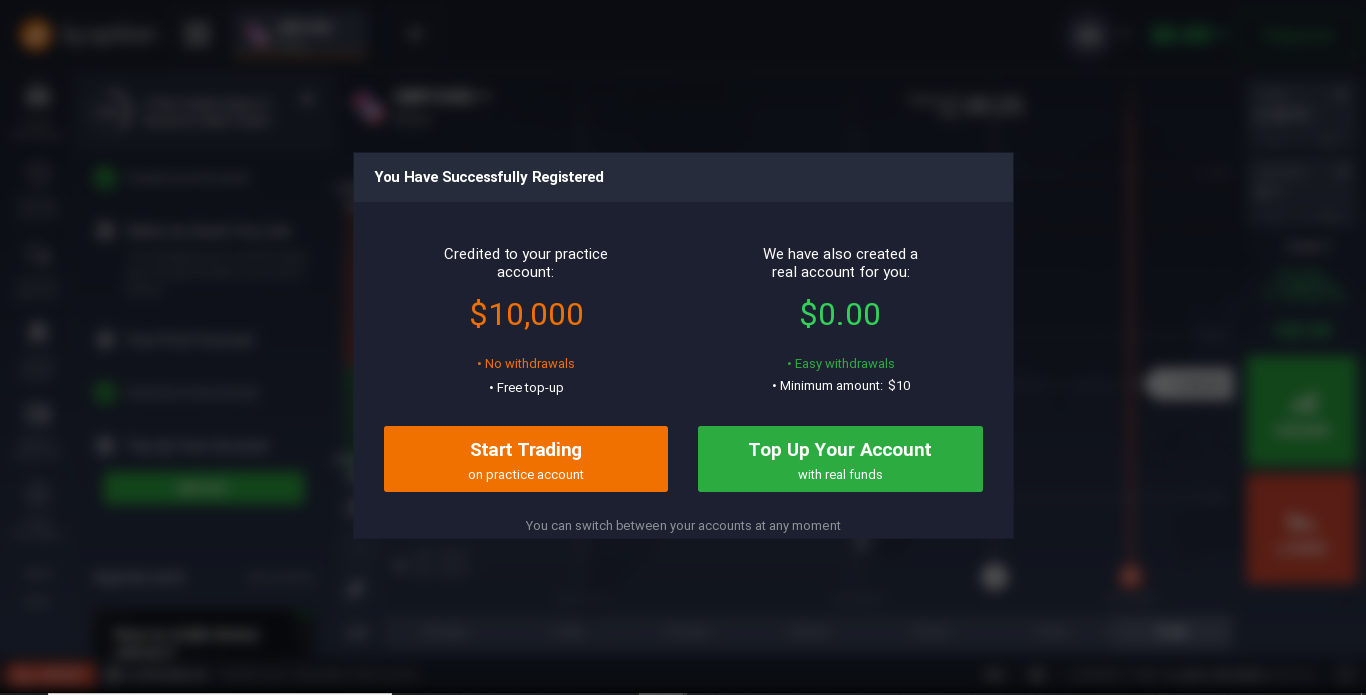

In order to start trading shares in the UAE, it is necessary to sign up for a broker.

How to trade stocks

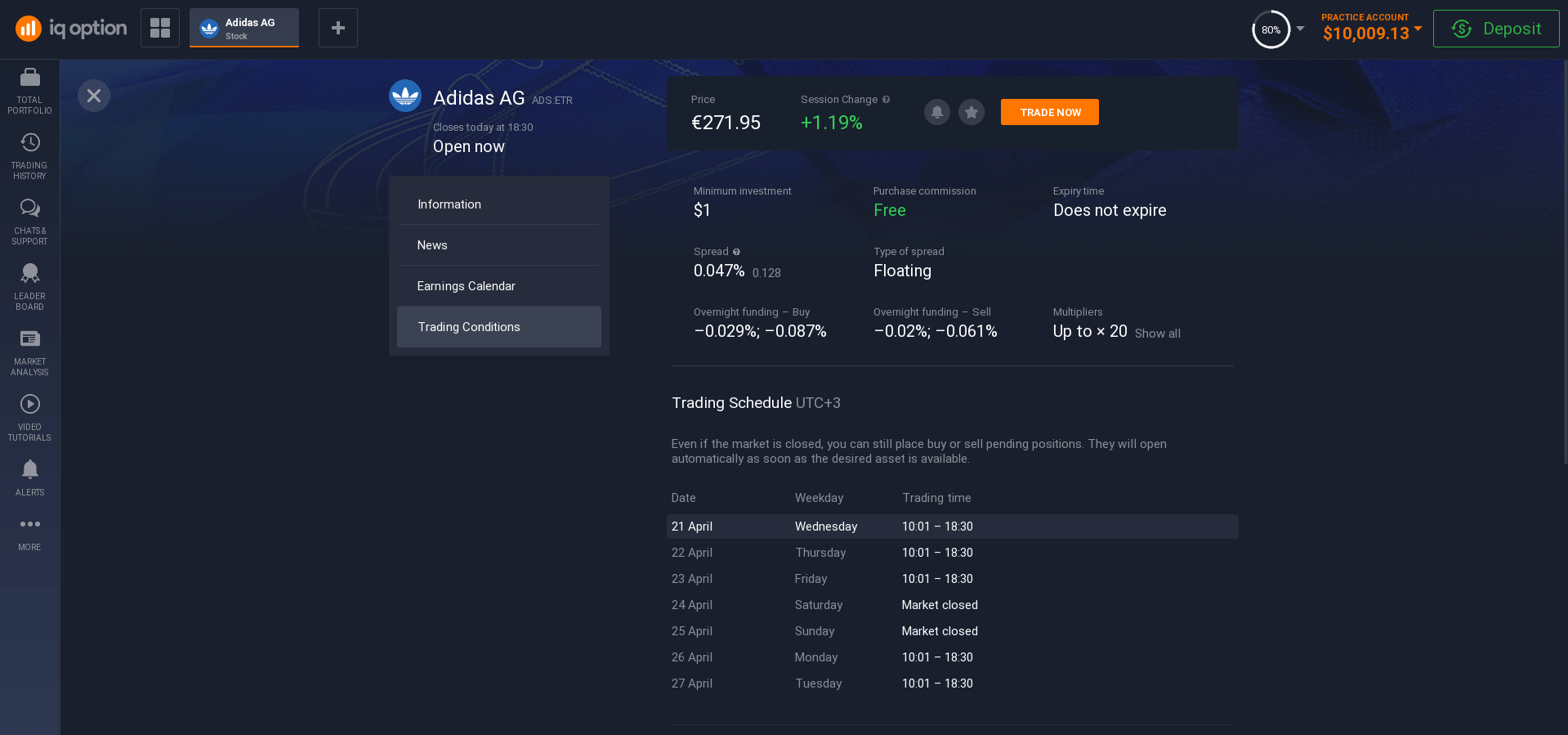

To start trading, choose a broker you can trust and register.

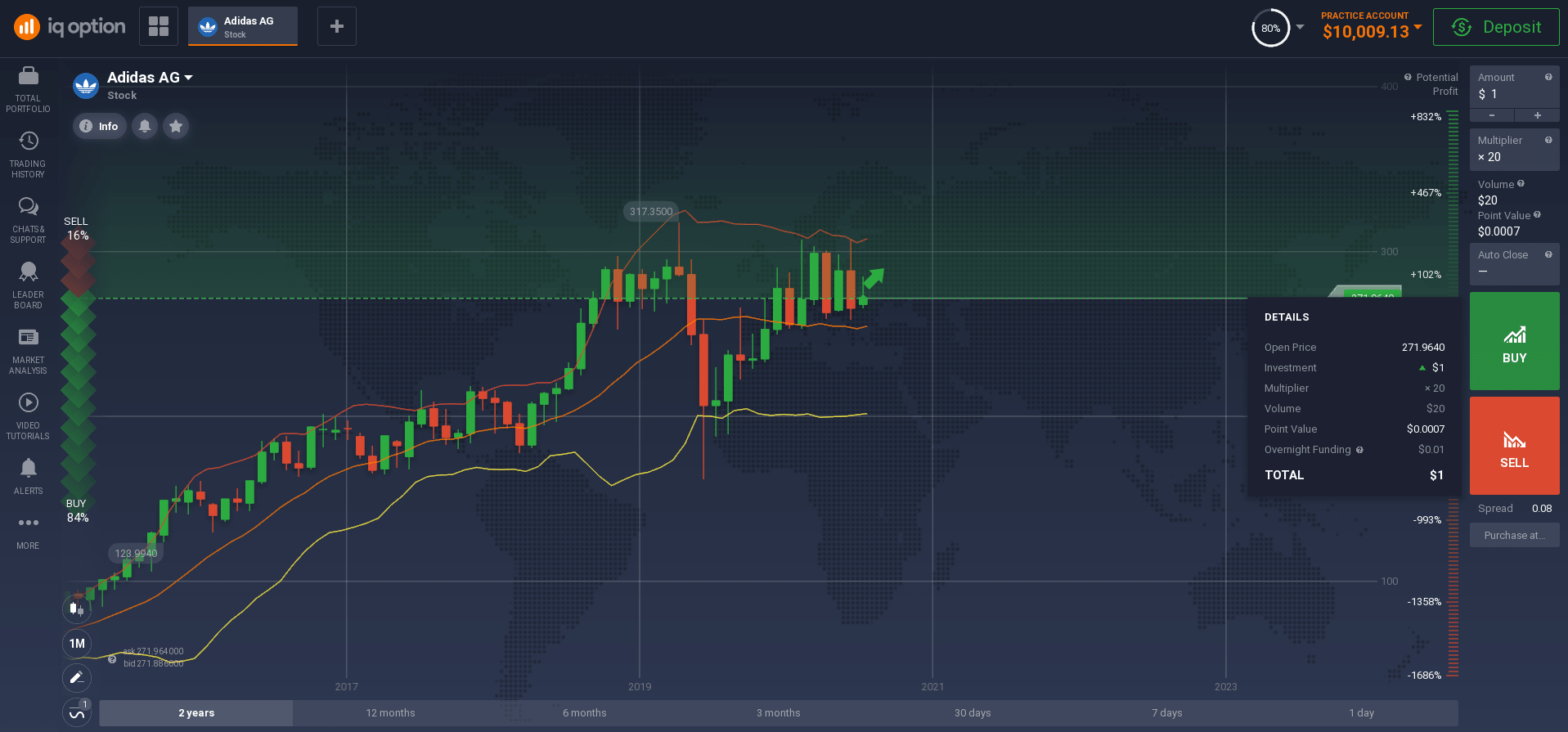

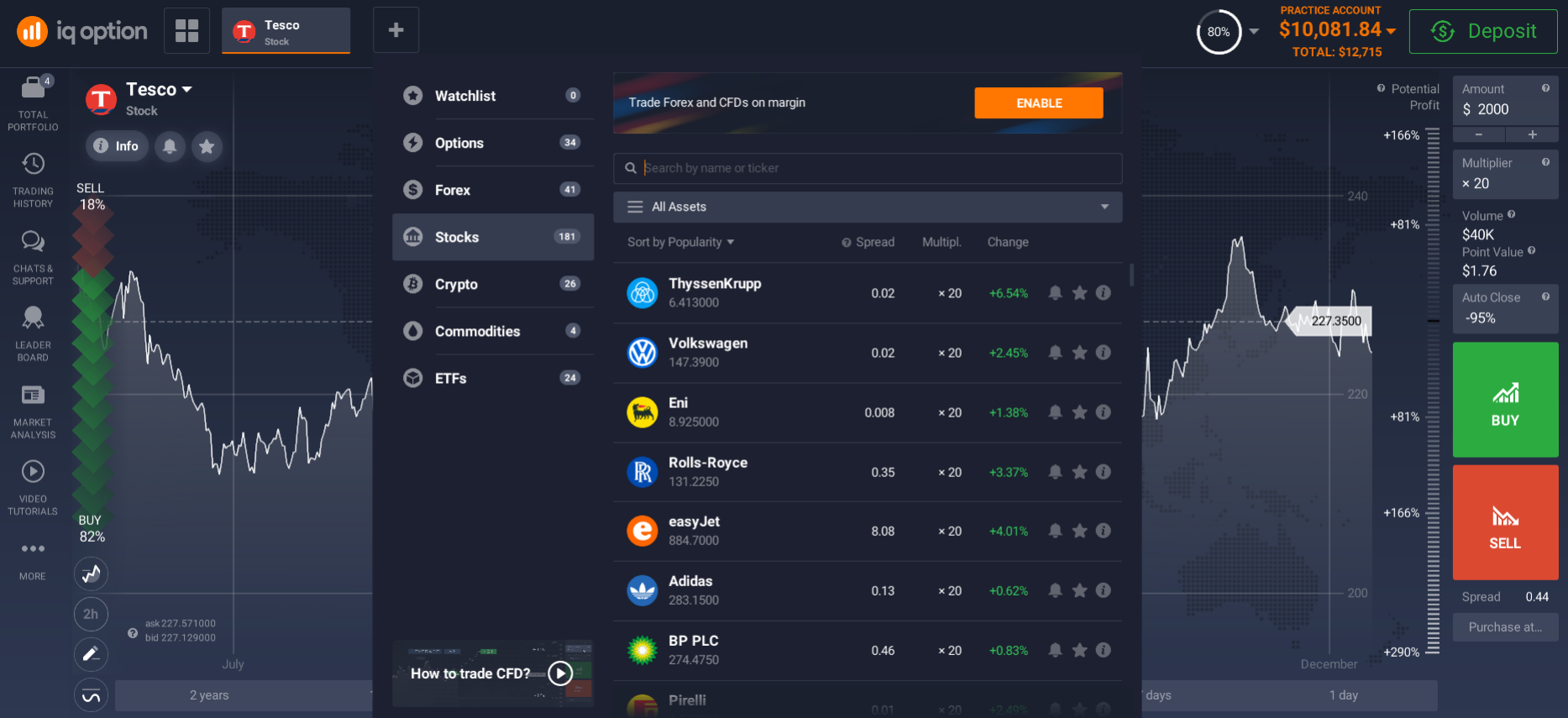

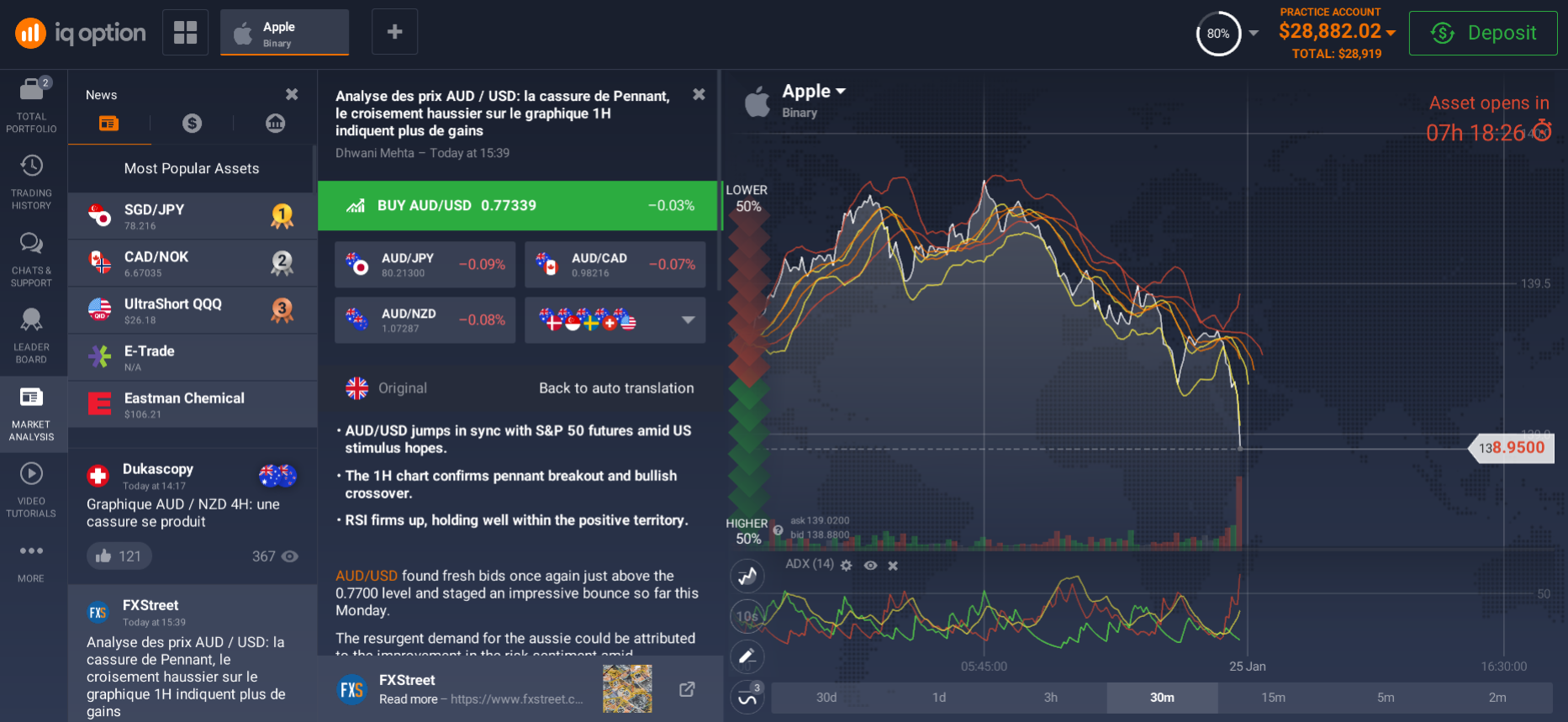

After registering, you must open a new asset on the stock, from the list of available ones.

Then select the company you want to trade with. Analyze the price chart using technical analysis tools. Do not forget to consider fundamental factors as well. Then determine the direction of the trend and predict its further behavior in the foreseeable future.

Think about it, and set the amount of money you want to invest in that particular trade. Remember that according to known risk management practices, you should not invest all of your capital in a single trade.

Now, depending on your prediction, select "Buy" or "Sell" shares in the UAE. When the time comes, close the trade. The greater the difference between the opening price and the current price (if the trend direction was predicted correctly), the higher the potential profit.

Stock trading in the UAE may seem simple because of the small number of variables involved. However, it does have a number of complexities, but if done correctly, it will be useful. It is always best to devote enough time to the company whose stock you intend to trade and learn how to use technical and fundamental analysis tools beforehand. Choose your broker and dive into the exciting world of stock trading in the UAE right now.

All forms of financial investment involve a certain amount of risk, and stock trading is no different. Even traders with years of experience cannot predict the right price movements every time.

People use different strategies, but it is important to note that there is no fail-safe strategy. It is also advisable to limit the amount of money you invest in a single trade as part of your own risk management.

Any successful trader carries out his activities according to certain rules and develops a plan of action, which together constitute his strategy. This is how a single stock trading strategy emerged.

There are some rules for successful stock trading:

- The most basic thing you should start to do in learning how to trade stocks is to learn the theoretical part. Learn all the words and terms and you will feel much more confident.

- Decide on your investment objective. You don't need to spread yourself thin, and try to do everything. Choose one direction, and work closely with it, study the information and subtleties of your goal.

- Do not forget to monitor the micro and macro-economic situation, not only on the stage of learning to trade stocks, but also afterwards. Always be aware of all what is happening in real time. It is a good idea to make it a habit to check stock news and forecast websites on a regular basis.

- Do not start with real trading. Trading stocks is not a cheap pleasure, and going to the auction without the necessary knowledge and practice is pointless. Start with a demo account.

You can use other criteria of classification or just to specify the proposed points. Try yourself by signing up on a trading platform.

How to choose a stock to trade

There is no stable and single strategy that will help in choosing the best stocks to invest in the UAE. It all depends on several factors, such as the outcome you are trying to achieve, your attitude toward risk, and the time and capital you have at your disposal. Rules for selecting stocks for investment:

- Choose stocks with smooth price movements. Pay attention to the liquidity of the stock and volatility it will help you with the selection of the right stock to trade.

- You need to pick stocks to trade from a price range of $15 to $75. There are bound to be profitable movies here. As you become more confident in trading, try to keep the momentum going upwards, taking out cheap stocks and adding in slightly more expensive ones.

- In order to select a stock to trade, you need to use not only charts but also technical analysis. Your task is to study as much as possible the companies you want to work with.

- You should not trade the first 15 minutes of the stock exchange opening. You risk losing all your money, remember that.

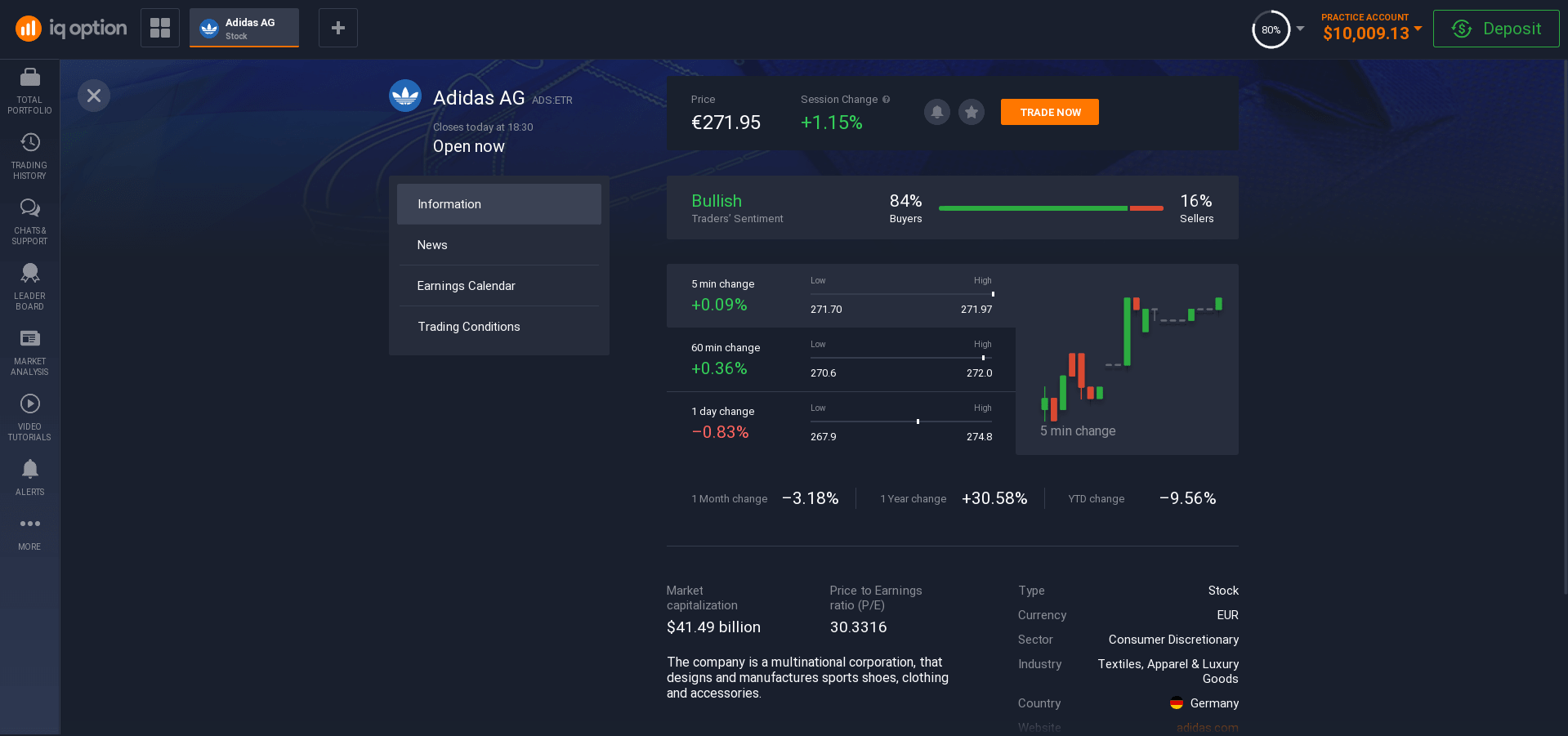

- Choose a stock with capital over $300 million, and pay attention to companies with a capitalization of more than $ 1 billion. In this company you can be sure, if the global investors have trusted it with their money. Also conduct an analysis of financial condition company.

- Pay attention to the company's financial statements (profitability, competitiveness), also not an unimportant point in choosing a stock of a particular company is dividend payment dates.

- Analysis of trends. This method is used to determine the deviation from the base plan by cost, timing, or content, using data from previous reporting periods. Trend analysis will help you predict the costs and revenues of the company in the next reporting period, thereby identifying all the strengths and weaknesses.

When choosing a stock to trade on broker, use it:

- Fundamental Analysis.

Keep in mind that fundamental analysis is centered around assessing the intrinsic value of stocks. This means that you must analyze both the qualitative and quantitative aspects of the industries and individual companies that make up your chosen industry.

- Technical Analysis.

Technical analysis is completely different from fundamental analysis - when selecting stocks using technical analysis, you must focus on price data and stock movements. This includes analysis of trends and patterns that can indicate future market movements.

There is a wide range of technical indicators that you can use when conducting trend analysis. The strategy you choose will ultimately depend on your trading style.

You can try these types of analysis by registering with brokers.

How to trade one stock - single stock trading strategy

Before you start trading stocks in the UAE, you need to choose this one stock trading strategy.

Breakout of the price level

This strategy takes into account levels, highs and lows that are immediately apparent to the trader. For example:

- Daily highs and lows.

- Local highs and lows.

- Support and resistance levels.

- Rounded price values.

The essence of this trading strategy: the price will move in the direction of the broken significant level, in which the graph has rested up to a certain point. At the same time, the trader should be very attentive as it is necessary to identify the direction of movements. After the penetration of an important level, it is advisable not to enter the market immediately, and to wait for confirmation, for example, if you see an increase in volumes.

Intrachannel strategy

All trades are made only in the direction of the trend. In an uptrend, you buy shares near support and sell them near resistance. In a downtrend, it's the other way around.This is due to the fundamental factors consolidate.

Trading inside a sideways channel

A sideways channel is a side channel. You buy shares above support and sell them below resistance. This trade requires a long range, it is better to use limit orders. Keep an eye on the retracement at all times, because the stock price can change in the opposite direction to the trade.

Top or bottom pick

There is an opinion that the quotation will not constantly fall or rise. A trader buys a stock after its value declines or goes short after it rises. In this stock trading strategy, be sure to consider historical highs and lows, "round" levels, as well as volumetric values of price peaks.

Correlation-Based Strategy

It is no secret that many indices are directly or inversely correlated (correlated) to stocks. For example, direct correlation implies an increase in the value of stocks with an increase in the value of the index. The reverse is the opposite. There are also shares, which are in no way correlated with indexes. Conclusion - follow the indexes and wait for the stock price stalling out to duplicate their movement to stocks, buying or selling assets.

Trading in baskets

Basket - a certain number of shares of different companies, when there is a significant correlation with the indices. Such stocks form a portfolio that can be sold or bought with the push of a single button. This one stock trading strategy requires not only good preparation and attentiveness, but also the right composition of the basket.

Choose the strategy that suits you best, study it and try trading stocks in UAE by registering with a reliable broker.

The most appropriate stocks for trading in the UAE

Stocks are probably the most common investment instrument. And they are great for beginners and professional investors alike. Let's figure out how to choose and buy the best stocks in the UAE and start trading with brokers.

- Choose the company's field of activity.

The choice of industry should be based on your interests and experience.

- Research companies in your chosen field.

Compare companies in the same industry: it may be that the dark horses are performing better than the established industry leaders.

- Check out the company profile.

Scrutinize all available information about the company How has it evolved? How has it transformed? How have important past events affected the movement of the company's stock? What are its plans for the future? Quite often the vector of the company's movement in the past determines its development in the future. Pay particular attention to income statements.

- Explore the company news.

A company's plans have a direct impact on your return on investment. If the company plans to launch a new product, if it has made a discovery, it can play into your hands.

- Examine the dynamics of the company

Evaluate the dynamics of the company and the industry in which it operates over the past few years. If the growth rate is declining or even worse has become negative, you should not look in its direction.

- Read analytics.

Major investment banks regularly publish their own recommendations.

- Pack your briefcase.

The most suitable stocks for trading the UAE:

- Robinhood markets, Inc.

- Coinbase Global, Inc.

- Etsy, Inc.

- GameStop Corporation.

- AMC Entertainment Holdings.

- Virgin Galactic Holdings.

- BioNTech SE ADR.

- Wayfair Inc.

Investing in stocks and earning income from them is not difficult, and don't let the multi-step process embarrass you. The multi-step approach in this case does not complicate the process, but facilitates it and improves the result. The rational approach takes time and your attention. The main thing to remember is that you spend your time and effort to minimize risks and generate income, and this is stimulating.