Trading platform software for real time trading

Trading is one of the most exciting activities. Once you become a successful trader, you can live and work anywhere in the world, be independent of routine and answer to no one. But despite its outward attractiveness, few newcomers realise the work and discipline that the stock market demands. Trading is a banking term and refers to making deals to buy and sell shares, securities and currencies to profit from changes in the value of the assets. The activity takes place on a platform, thanks to which the trader can contact the broker. Therefore, the choice of the platform has a strong influence on the outcome of a trader's actions.

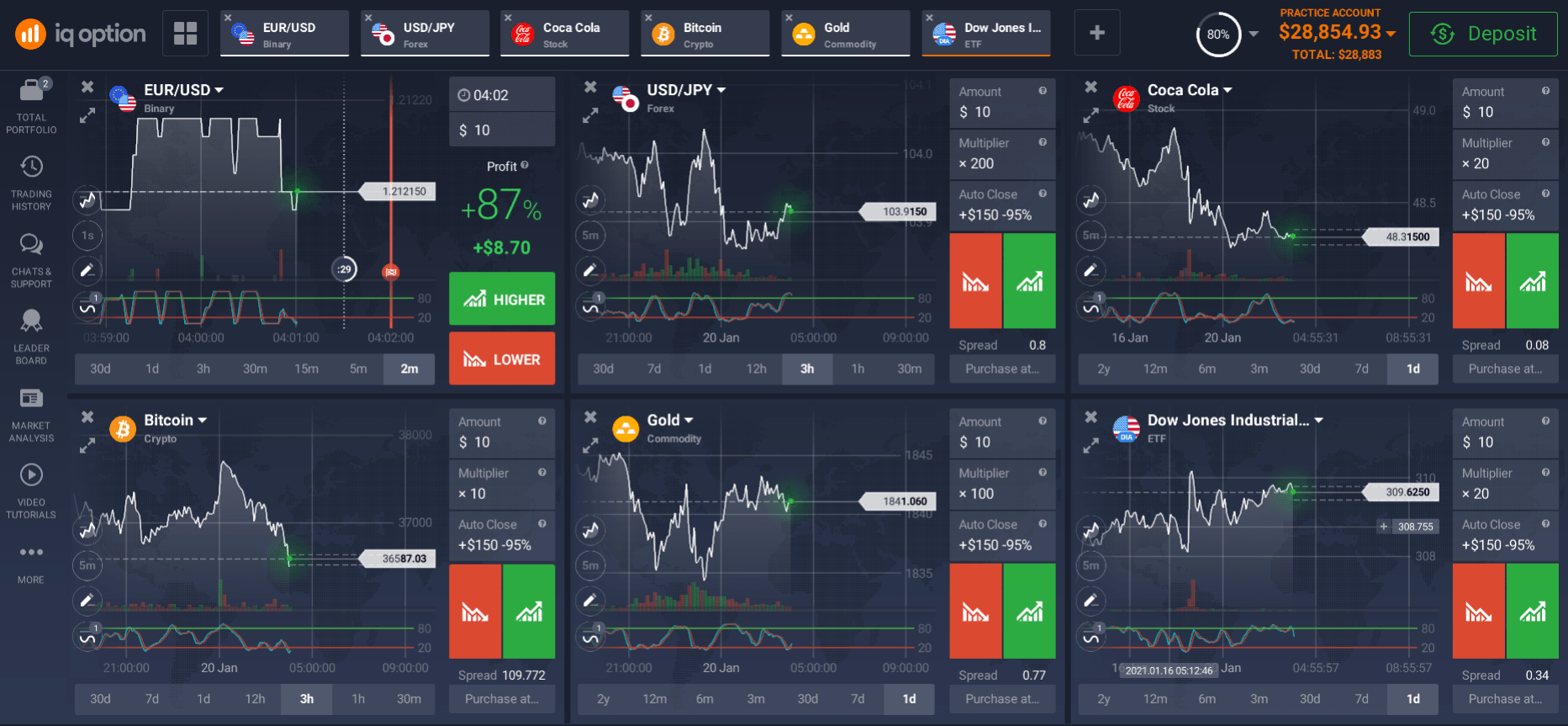

Programmes designed for online trading of different assets are called trading terminals or trading platforms software. A trading platform software is installed on a computer or mobile phone.

How to choose a real time trading platform software in the UAE?

It is best to choose a trading platform on your own without relying on a few advertising reviews. To do so, you need to list the features and capabilities that platform developers offer, choose which ones are a priority, and build your internal platform ranking.

A real time trading platform, or trading terminal, is nothing more than software that allows you to interactively in the international forex market and make various trades on it. Of course, brokerage companies may also refer to platforms as trading clients, but all these designations mean the same to end-users.

What are the main differences between the trading platforms software?

Let's try to understand the differences between different trading platforms and describe some of them.

In principle, many existing platforms are convenient in their way; here, as they say, like many people, so many opinions. Still, there are objective parameters that should not be overlooked when choosing a platform, these are:

- Program speed and performance.

Some programs have low speed and performance, which affects delays in a graphical representation of quotes and the timeliness of deals - Day Traders get angry when a program slows down. Still, those who do not trade intraday may not pay much attention to it.

- Functionality.

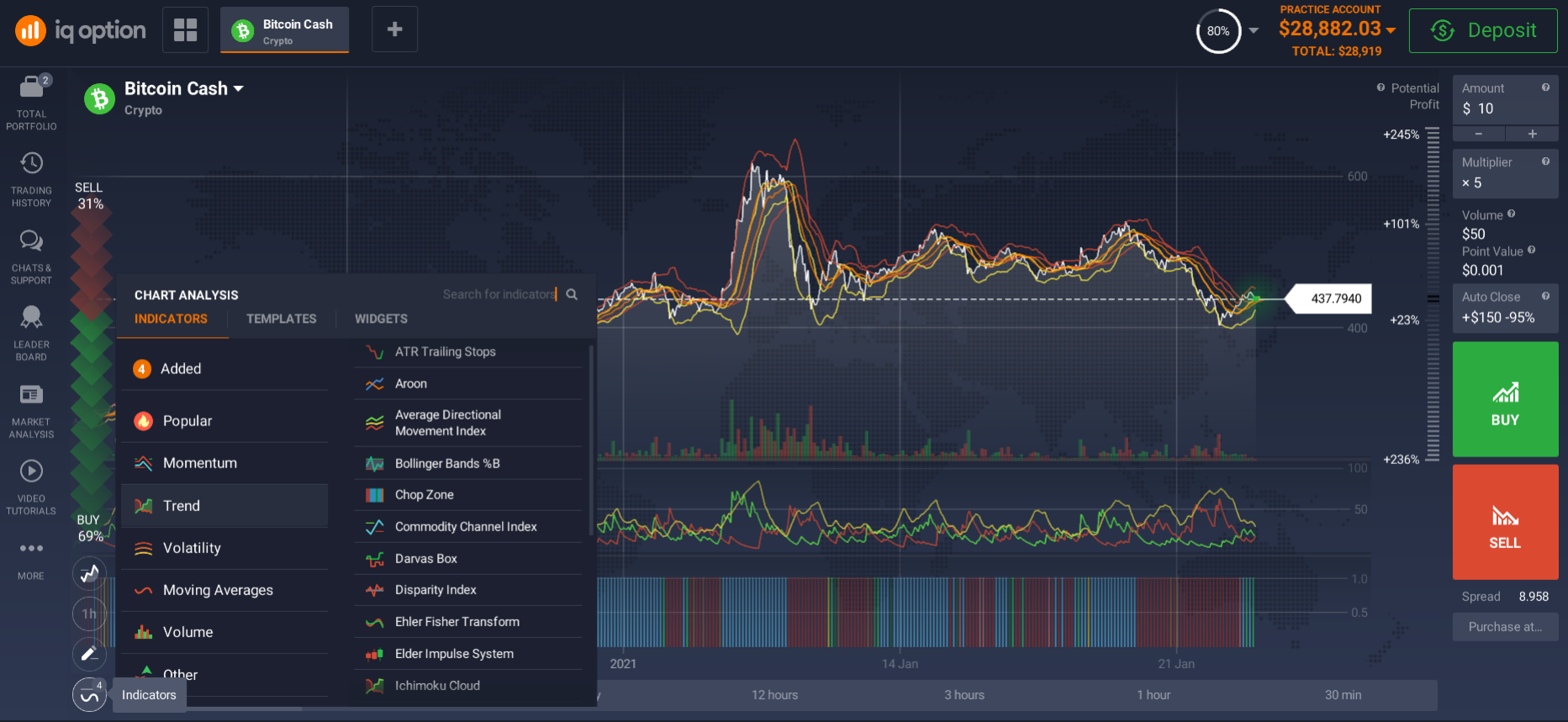

What lies beneath this parameter? The number of analytical tools, including technical indicators and charts, the number of timeframes (timeframes). The number of the simultaneous opening of quotation windows, the possibility to create your indicators and automated trading, availability of programmes for automated trading (expert robots or advisers), modes and types of orders for deals, services of fundamental analysis and an economic calendar, coverage of financial markets and trading platforms, the number of available financial instruments.

- Interface usability.

The intuitive interface, the ability to customise it, the colour scheme are essential factors that affect the comfort of trading on the platform in real time. Moreover, it is known: "meet a man by his clothes ...", so users' first impression depends on the design.

- Security.

Security of your trades and confidentiality is inherent in the platform, but these factors also depend on the brokerage company you choose.

- Mobility.

Mobility isn't the ability to install the program on mobile devices, which is very important in today's world. It is also the program's compatibility with various operating systems on which it may fail or malfunction completely, in which case you need to buy smartphones and tablets for the program, not vice versa.

Of course, the high functionality of a market trading platform software is crucial, but sometimes you can find programmes with less functionality but more adapted to specific trading conditions.

So, there are many trading terminals on the market today from different firms, and they differ in functionality and usability. Still, often excessive functionality only confuses the novice trader, and usability becomes a subjective thing. So the advice here is to try different programs yourself to see which one is right for you.

What to trade on the trading platform?

The international forex market is by far the fastest-growing financial market in existence. Forex owes its phenomenal growth, its popularity to two things: a relatively low economic and information entry threshold and a vast amount of advertising support.

Either stock or commodities trading requires a lot of capital (because even small blocks of stocks and lots of commodities cost a pretty penny). Also, to be successful in these markets, you have to have a basic understanding of trading itself and the economic processes that determine the price movement.

For example, to trade shares, you need to know at least something about the issuing companies and their business sectors; to trade commodities, you need to know about agricultural and industrial raw materials or energy markets.

Having a computer, Internet access and 100 dollars in the pocket, a person, in principle, can start trading on Forex even on the next day after he learned about its existence. But such trading will have little in common with actual trading but is instead a kind of lottery or a casino. Of course, to work in the currency market, you have to know how exchange rates are formed.

Recently, however, many Forex brokers started offering currency pairs and such financial instruments as CFDs (Contract for Difference) and metals (gold, silver and, less frequently, platinum, palladium, copper, etc.).

Let's dwell a little more on the concept of CFDs. British stock market brokers invented this type of financial instrument in the early 1990s to circumvent the organisational and economic costs of stock trading. Instead of buying or selling actual shares, inventive brokers offered their clients to buy or sell contracts for the price difference of such shares. Thus, the client was spared the necessity to register the ownership of the purchased shares, as well as the tax, which is collected from all traders on the stock exchange. If the price of the underlying shares went up after some time, the holder was able to sell the contract at the current price of these shares, and the difference in purchase and sale price was transformed into his profit.

As time went by, apart from CFDs on shares, corresponding contracts on stock indices, commodities, and other marketable assets also appeared. Because CFDs are not subject to all the strict rules of stock and commodity markets, this instrument is becoming more and more popular among Forex traders.

CFDs allow anyone to trade stock instruments using all the advantages of the Forex market: low minimum equity, high leverage and high liquidity.

What should a novice trader know?

So, a trader is a financial/stock market trader who seeks to make a profit. But, at the same time, the trader works directly in the market: analyses the situation and concludes trade deals. So, if you are ready to connect to the real time trading platforms and start working with your savings, you are a novice trader. And as a novice trader, you need to know the basics of trading and strategies so you don't make mistakes and fall prey to fraudsters.

Strategies for traders

Indeed everybody is familiar with the terms "bulls" and "bears" about the stock exchange. But not everyone knows that these are the two main strategies of traders.

- Bulls are traders who expect prices to rise, enter into a contract to buy assets, and wait for a new rise to sell at a higher price and get the difference as income. You do not need to be a mathematician to understand that bulls stimulate the prices of the asset (buying - higher demand - higher prices).

- As it is commonly expressed, Bears play on the downside, entering into contracts to buy and waiting for asset prices to fall to buy as cheaply as possible. Instead, the bears' actions are pulling prices down.

There is another critical division of strategies.

- Trading on the trend - a trader opens trades in the direction of price movement. As a rule, this is an ideal option for a beginner, as it is a simple strategy with minimal risks and the possibility of large profits.

- News trading is an option for experienced traders. In this case, fundamental analysis is performed first, and then trades are opened for multidirectional trends. This is quite a nerve-racking strategy, requiring exceptional analytical skills.

Again, this is not an exhaustive list of strategies. Experienced investors never stick to any one style; they change and combine strategies depending on forecasts, market conditions and specific asset types.

But it is not enough to know the strategies and identify yourself as a bull or a bear. For successful trading, you need knowledge of legislation and trading rules, a good understanding of theory, understanding of how the exchange and the stock market work, planning and analytical skills, the ability to notice what seems to be insignificant details and, of course, free capital.

Let us remind you that you should start with a small turnover. And high-end specialists are there to help you - do not avoid the services of professional brokers and financial advisers.

How to start using a real time trading platform in the UAE?

Undoubtedly, one of the principal aides of an active private investor in the XXI century - trading platforms for traders. They are diverse on the market and can be accessed through your professional broker.

Beginners should begin their immersion into the IT part of trading by studying the indicators and analysis charts in the trading terminal interface. They are easy to read and help them understand the basics. And then, there are two severe levels: software for professionals and software for automated trading (incidentally, it is better to choose the one where the investor can analyse and change strategies).

Registration process

Once you have chosen the software and installed it on your computer or mobile phone, you need to identify the registration process. For this, the platform will require some personal information. However, it will not take you long to register.

Opening a demo account

So it is not a good idea for a beginner to earn real money as soon as they are acquainted with the basics of trading. Instead, beginners should start their way on the trading platform by opening a demo account. The priority of the demo account should be mastering the platform, making basic operations automatic and learning the basic parameters of the trading account.

Opening a real account

When you are sure that you have experimented enough on the demo account and it is time to start real action, open a real account. All you have to do is make a minimum deposit. Then all the functionality of the platform will be available to you in full. Now you can start trading. Remember, trading is risky. Take your actions wisely. Then you'll be able to achieve greatness.